When Do You Get Tax Returns

- Get link

- X

- Other Apps

To get a timeline for when your refund will arrive you can go to wwwirsgovrefunds. Deadline to file your taxes.

How Early Can You File Your Taxes To Get Your Tax Refund

How Early Can You File Your Taxes To Get Your Tax Refund

Tells us the amount of expenses you are claiming tells us about the amounts and types of untaxed income you received.

When do you get tax returns. Depending on the complexity of your tax return you could get your tax refund in just a couple of weeks. People and businesses with other income must report it in a tax return. January 31 2020 - 919 am EST.

An individual income tax return. Tax situations requiring a specific return or form There are exceptions such as if you had residential ties in another place where you would need a specific tax return. For those that need tax transcripts however IRS can help.

Generally you can expect to receive your state tax refund within 30 days if you filed your tax return electronically. If you have not filed your 2017 IRS Tax Return and expect a tax refund you have until 04152021 to submit the return on paper and to claim your refund. Your Taxes April 15.

If you need to complete a tax return you must lodge it with us or have registered with a tax agent by 31 October. A tax return covers the financial year from 1 July to 30 June. In fact you can check out the IRSs Wheres my refund tool to find the status of your tax refund right now.

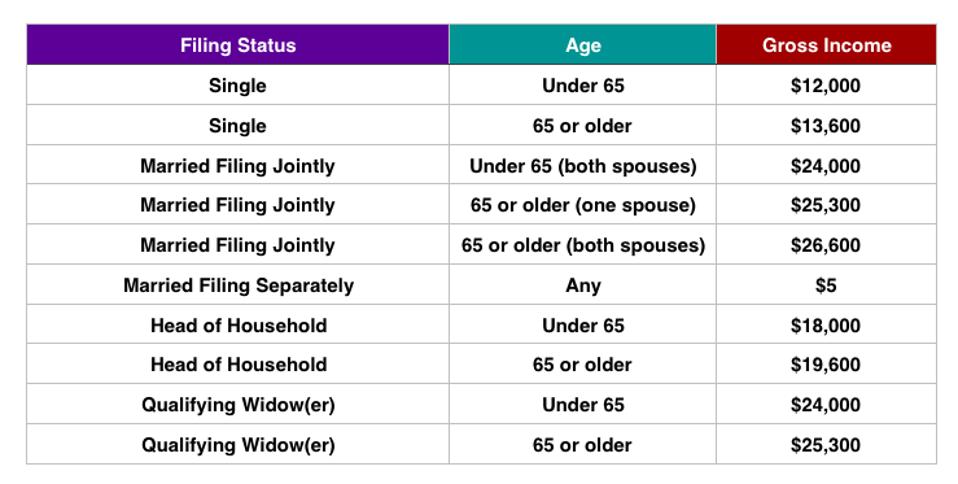

Ultimately though how soon you get your refund back depends on two things. As tax season approaches you may look at your past years income and think that it was too low to send in a tax return. Federal minimums range from 12400 to 24800 for tax year 2020 but even.

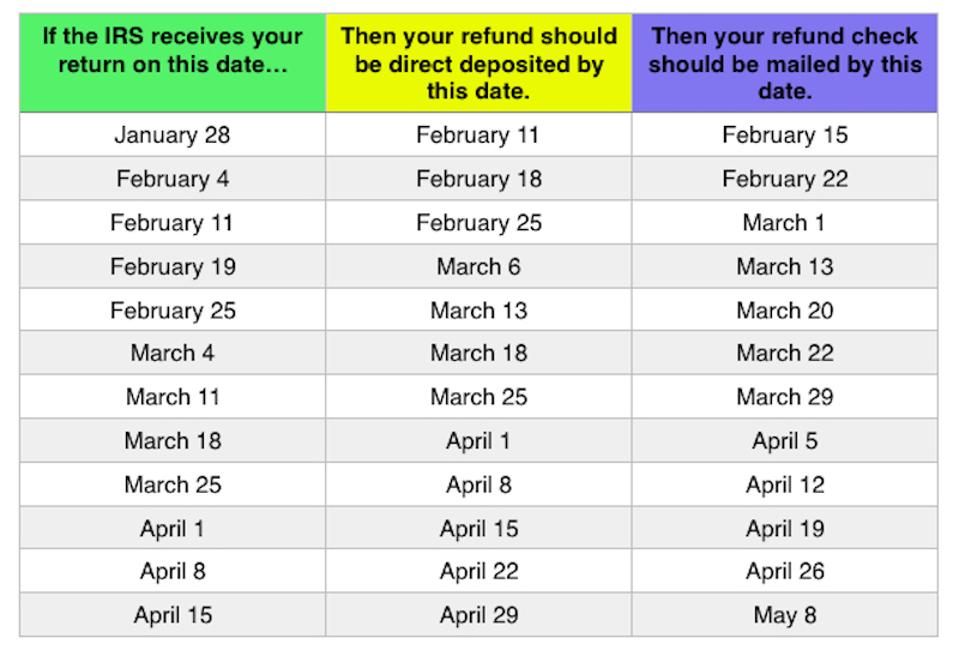

If you file your taxes early you dont have to wait until after the tax deadline to get your tax refund. As you might expect every state does things a little differently when it comes to issuing tax refund. The date you get your tax refund also depends on how you filed your return.

Luckily for you the IRS is very good about getting your tax refund to you. Tax is usually deducted automatically from wages pensions and savings. For example with refunds going into your bank account via direct deposit it could take an additional five days for.

2019 Return refund is April 15 2023. April 15 is the due date for all 2020 tax returns but filing your taxes sooner will not only potentially speed up delivery of any tax refund you might collect but also position you to get any. This form shows the income you earned for the year and the taxes withheld from those earnings.

You will automatically receive your 2020 Income tax package by mail. When you lodge a tax return you include how much money you earn income and any expenses you can claim as a deduction. Deadline to file your taxes if you or your spouse or common-law partner are self-employed.

Employers must send you your W-2 by January 31 for the earnings from the previous calendar year of work. And according to the IRS they issue nine out of ten refunds back to the taxpayer within 21 days after they file their taxes. You can check the status of your refund within 24 hours after the IRS notifies you that it has received your e-filed tax return.

If you filed a paper tax return it may take as many as 12 weeks for your refund to arrive or longer if your state has been or still is under social distancing restrictions. The tax year is from 1 April to 31 March. If its been longer find out why your refund may be delayed or may not be the amount you expected.

Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns. The IRS officially opened the 2020 income tax season on Monday January 27 when it started accepting tax returns. How do I get my tax refund.

The 2018 Return refund deadline is April 15 2022. Prior year tax returns are available from IRS for a fee. Filing dates for 2020 taxes.

Those who need a copy of their tax return should check with their software provider or tax preparer. IRS Summertime Tax Tip 2017-11 July 26 2017 Taxpayers should keep copies of their tax returns for at least three years. If you need to send one you fill it in after the end.

Get ready to pay up if you. You were a Quebec resident on December 31 2020. When youre ready to file youll want to check over your return before you hit send since even small errors can create delays in your refund.

After that date your refund will.

2019 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

2019 Tax Refund Chart Can Help You Guess When You Ll Receive Your Money

/income-tax-deadlines-2021-75aaceca6a8f47eabc8a17a9185f24ac.png) Federal Income Tax Deadlines In 2021

Federal Income Tax Deadlines In 2021

How Much Money Do You Have To Make To Not Pay Taxes

How Much Money Do You Have To Make To Not Pay Taxes

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

Irs Delays The Start Of The 2021 Tax Season To Feb 12 The Washington Post

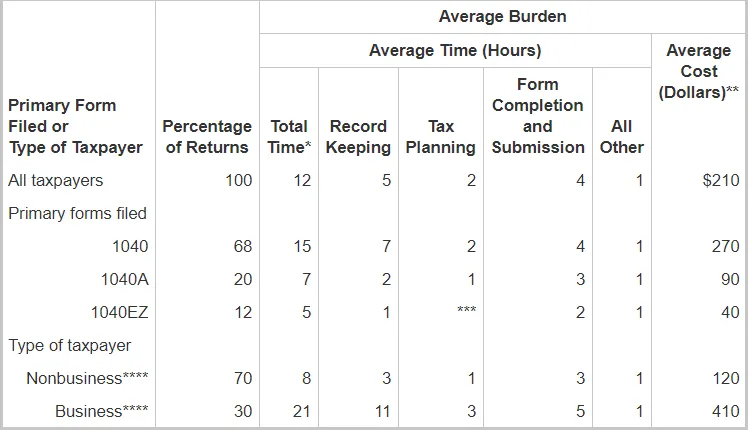

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

How Long Does It Take To File Your Tax Return And Get Your Tax Refund Freshbooks

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Do You Need To File A Tax Return In 2019

Do You Need To File A Tax Return In 2019

When Will I Receive My Tax Return Where S My Tax Refund How To Check Your Refund Status

When Will I Receive My Tax Return Where S My Tax Refund How To Check Your Refund Status

How To Find Out How Much You Paid In Income Taxes On Your 1040

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

2021 Irs Tax Refund Schedule When Will I Get My Tax Refund Smartasset

/when-you-haven-t-filed-tax-returns-in-a-few-years-3193355-c6f6b92413334c7284aecb6b2162b900.png) What Happens If You Don T File Taxes

What Happens If You Don T File Taxes

/tax-preparation-prices-and-fees-3193048_color22-02e553ad83d64fb6803944caea928d8b.gif) How Much Is Too Much To Pay For Tax Returns

How Much Is Too Much To Pay For Tax Returns

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

When To Expect My Tax Refund Irs Tax Refund Calendar 2021

Dude Where S My Refund The Turbotax Blog

- Get link

- X

- Other Apps

Comments

Post a Comment