Putting Money In Roth Ira

- Get link

- X

- Other Apps

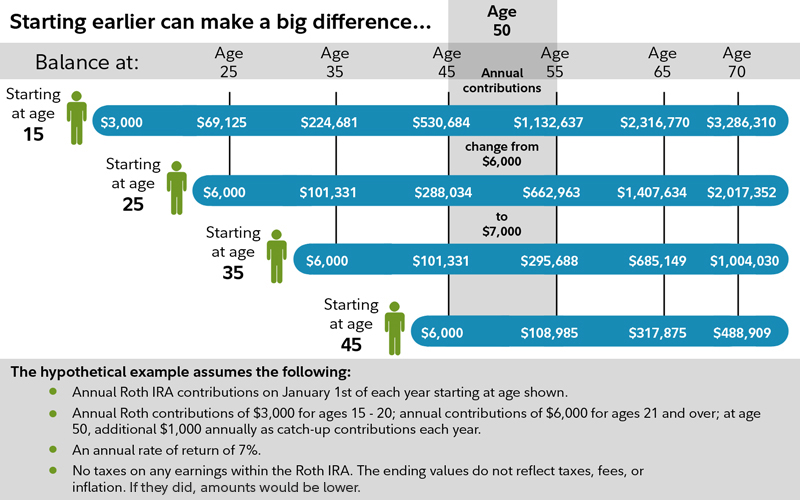

For individuals aged 50 and over they can contribute an additional 1000 as a catch-up contribution for a total of 7000. In 2020 you can put away 6000 in a Roth IRA and allow it to grow tax-free.

Iras Traditional And Roth Voya Com

Iras Traditional And Roth Voya Com

For 2020 and 2021 you can contribute up to 6000 to your Roth IRA or 7000 if youre age 50 or older.

Putting money in roth ira. Theres one exception to the rule that Roth IRAs dont give you an upfront tax break. Those who are aged 50 and over can contribute an additional 1000 which is called a catch-up contribution. The annual contribution limit to a Roth IRA is 6000 for 2020 and 2021.

If youre eligible for a spousal IRA you can double your familys annual Roth IRA contributions. Before you plunge your 6000 annual limit into a Roth individual retirement account for 2020 stop for a second and look at some fresh data out of. Only earned income can be contributed to a Roth IRA.

In a traditional IRA you make contributions with pre-tax dollars then pay taxes on all profits from this account when you withdraw the money in retirement. First theres a limit to how much you can invest. Imagine that youve been diligently putting money away in your Roth IRA retirement fund for the last 10 years as any savvy investor would do.

You can contribute to a Roth IRA only if your income is less than a certain amount. At 50000 single with no deductions your Federal Tax bill is estimated at around 6250. The maximum contribution for 2021 is 6000.

2 You have from Jan. 2 There are. The money you sock away in an IRA can potentially grow to over 500000 by the time you retire assuming you start early enough invest enough money consistently and earn a.

In a Roth IRA you pay taxes on the income you put in but pay none when you take the money. Putting money into a Roth IRA does not mean you wont be able to tap into those funds prior to retirement if you must. You take money out of your Roth pre-retirement.

As you might have guessed the best really the worst has been saved for last. Second you can only make full contributions to these accounts if. 1 of the tax year to April 15 of the following year when your tax.

At your ages you can each contribute up to 6000 to a traditional IRA a Roth IRA or any combination of the two you. Some low- and middle-income taxpayers can use the Savers Credit to. Families often use the spousal IRA to double the amount they can contribute to IRAs each year.

You have until April 15 2021 to make IRA contributions for tax year 2020. Always Do The Math Before Contributing To A Roth IRA Lets say you make 50000 a year and contribute to a Roth IRA. The annual contribution limits for Roth IRAs is 6000 for 2020 and 2021.

Here is the method that has destroyed the. Investors do have the option of. This equals an effective tax rate of 125.

Contributing To Your Ira Fidelity

Contributing To Your Ira Fidelity

How To Start Contributing To A Roth Ira

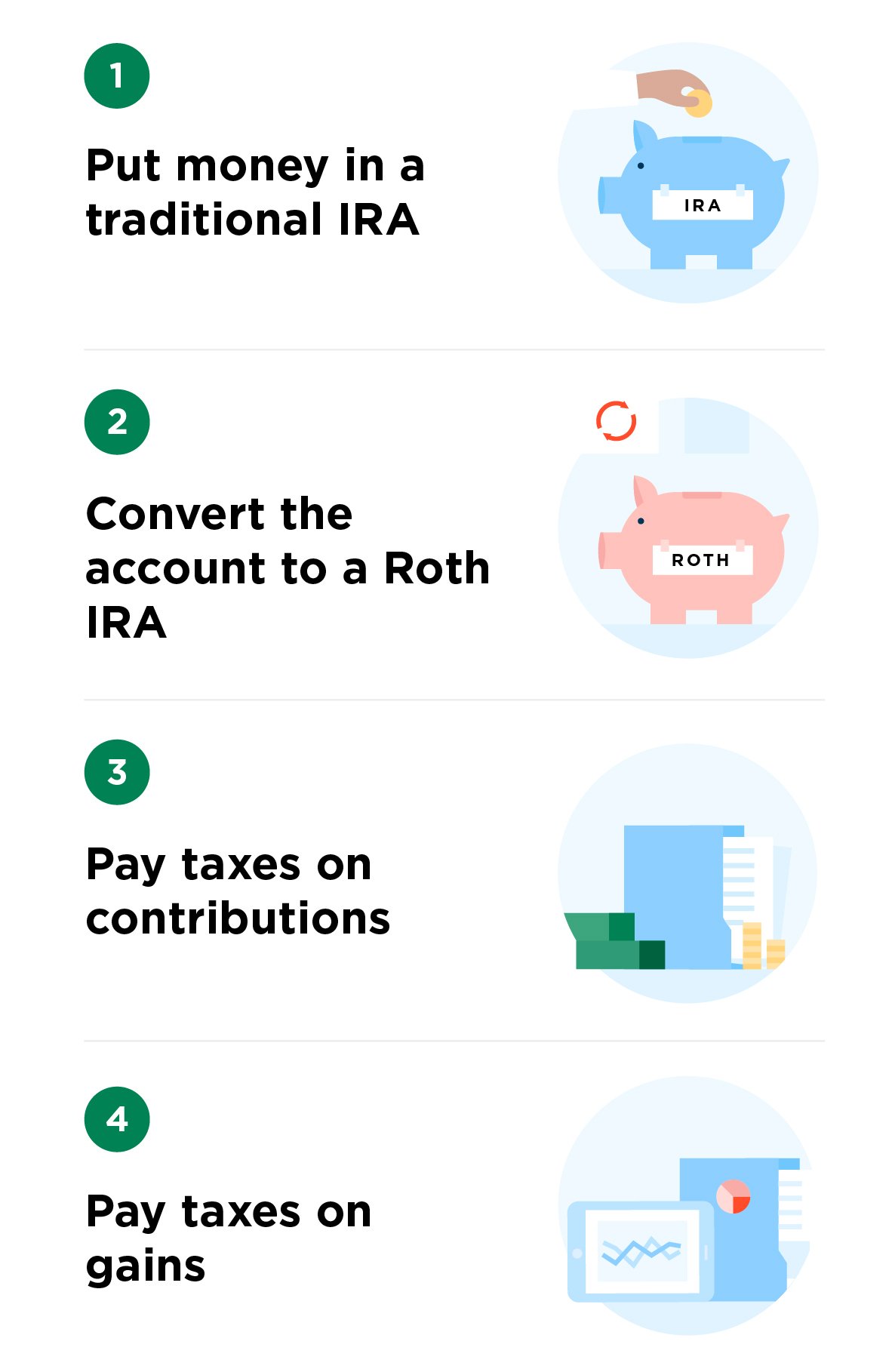

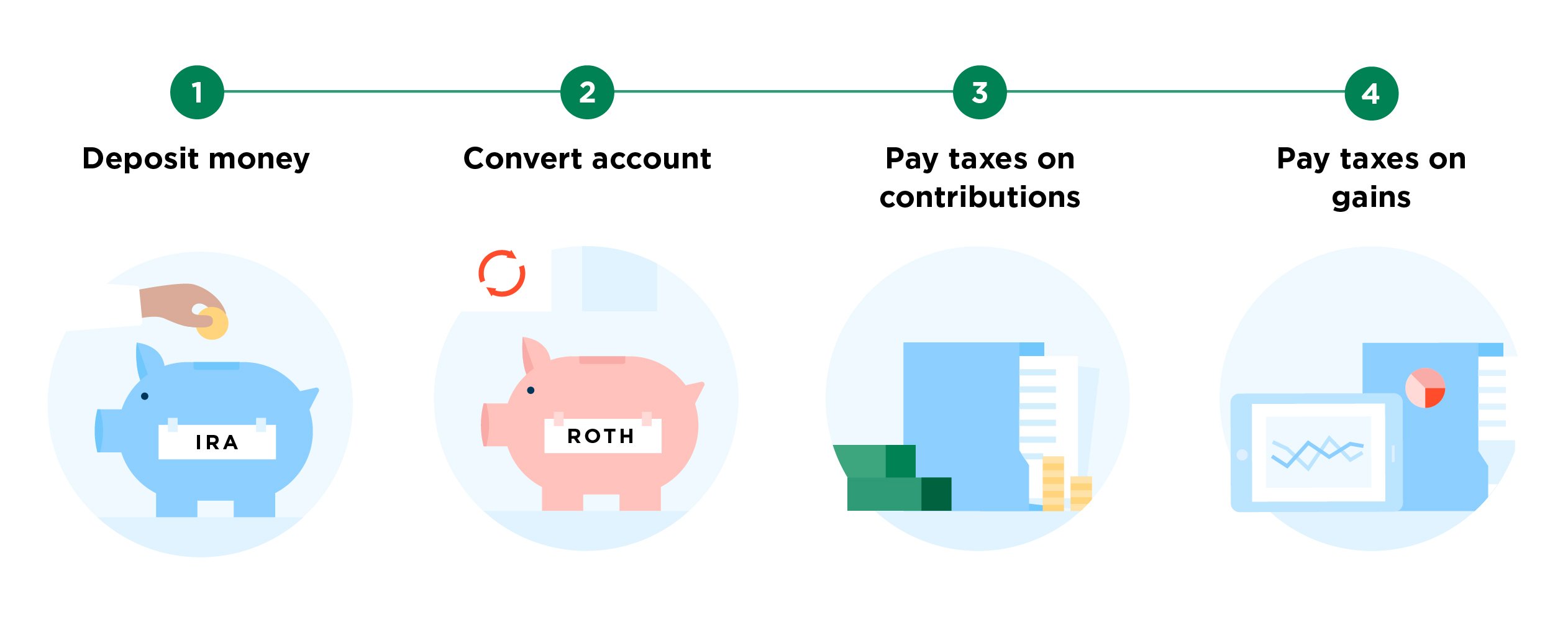

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Why You Should Save Money In A Roth Ira When You Re Young

/what-to-do-if-you-contributed-too-much-to-your-roth-ira-49102ec9ed7948d2863c9ea0e7581dce.png) Your Options For Excess Roth Ira Contributions

Your Options For Excess Roth Ira Contributions

How To Start A Roth Ira Ramseysolutions Com

How To Start A Roth Ira Ramseysolutions Com

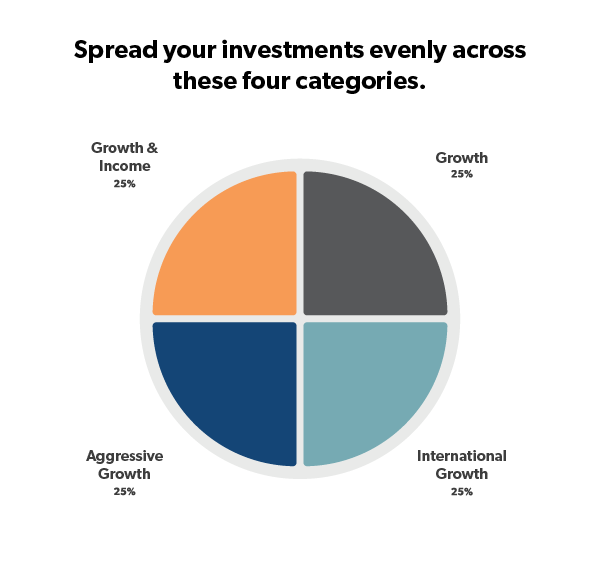

Infographic How To Invest In A Roth Ira Investing Finances Money Finance Investing

Infographic How To Invest In A Roth Ira Investing Finances Money Finance Investing

The Only Reasons To Ever Contribute To A Roth Ira Financial Samurai

The Only Reasons To Ever Contribute To A Roth Ira Financial Samurai

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Backdoor Roth Ira What It Is And How To Set One Up Nerdwallet

Roth Iras Are Ultra Flexible Here S Why That S A Bad Thing The Motley Fool

Roth Iras Are Ultra Flexible Here S Why That S A Bad Thing The Motley Fool

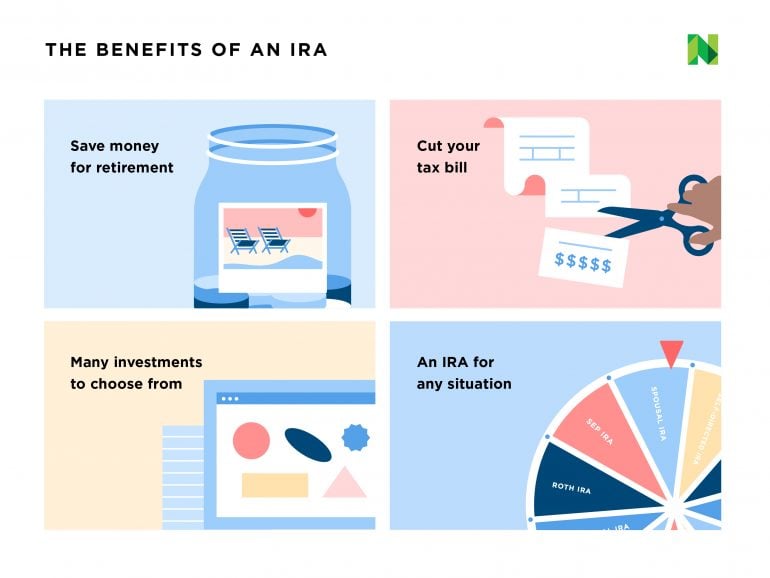

Roth Ira Contribution Rules How To Start One Nerdwallet

Roth Ira Contribution Rules How To Start One Nerdwallet

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Money Roth Ira Investing

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Money Roth Ira Investing

Comments

Post a Comment