Can You Have A Roth Ira And A 401k

- Get link

- X

- Other Apps

Having a Roth 401 k plan at work doesnt limit your ability to contribute to your personal Roth IRA. By rolling over your Roth 401k into a Roth IRA you can avoid IRS distribution requirements.

Roth Ira Vs Roth 401 K Simplefinancialfreedom Com Finance Investing Retirement Savings Plan Finance

Roth Ira Vs Roth 401 K Simplefinancialfreedom Com Finance Investing Retirement Savings Plan Finance

And in some cases based on the fees in your 401k an IRA might actually be a better place to invest your money.

Can you have a roth ira and a 401k. In fact building up your savings in. Investing in both a 401 k plan and a Roth IRA offers the perfect combination of tax savingssome now and some in the future. The list includes work-sponsored retirement accounts like a 401k or 403b to traditional IRAs and Roth IRAs plus every other type of retirement account you can think of.

Can you have a Roth IRA and a 401 k. ROTH IRA CONTRIBUTIONS. Roth 401 k to Roth IRA Conversions The rollover process is straightforward if you have a Roth 401 k and youre rolling it over into a Roth IRA.

But dont forget about the five-year rule and other laws. Can I also continue to contribute to my Roth IRA. A 401k and Roth IRA can be a powerful combo for your retirement savings.

But depending on your income you may not be able to have both. You can contribute up to 19500 in 2020 to. Yes you can contribute to a Roth IRA and a 401 k at the same time.

Depending on your income however you may have to. Yes you can invest in both an IRA and a 401k or a Roth 401k and a Roth IRA at the same time or any combination of those accounts. You can contribute to both a Roth IRA and an employer-sponsored retirement plan such as a 401 k SEP or SIMPLE IRA subject to income limits.

If you want enough money to have an enjoyable retirement the time to start saving is now. While you can also contribute to a Roth IRA and a solo 401k plan not everybody qualifies for making a Roth IRA contribution if their modified AGI is. I am allocating all of my salary deferrals to the Roth 401k.

If you make a 75000 salary and. Roth IRA contributions are made with after-tax dollars so theres no conflict between this type of plan and a 401 k which is funded with pre-tax dollars. The transferred funds have the same tax basis.

Yes you can contribute to both a 401 k and a Roth IRA but there are certain limitations youll have to consider. This article will go over how to determine your eligibility for a Roth IRA. My 401k plan offers a Roth 401k option.

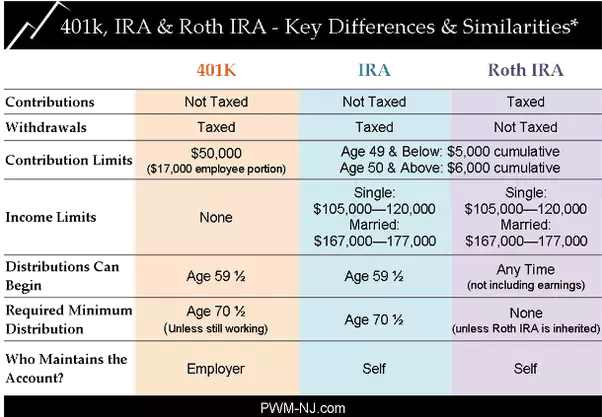

Although you must still have taxable compensation to be eligible for a traditional IRA there is no income limit for participation so you could have a 401k and a traditional IRA even as a high earner. If your income is too high for a Roth IRA and so you cant have a 401k and a Roth IRA consider investing in a traditional IRA to supplement your 401k contributions. Roth IRAs also have a lower contribution limit 6000 per year compared to 19500 for a Roth 401 k for both 2020 and 2021and do not allow for matching contributions.

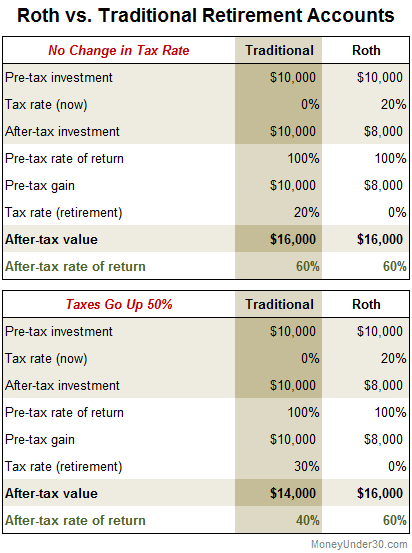

Contributing to both a Roth IRA and an. Participation in an employer plan does not disqualify you from contributing to an IRA or a Roth IRA as long as you meet the requirements for making those contributions. A traditional 401 k has pretax contributions and Roth IRAs have post-tax Ryan Marshall a New Jersey-based certified financial planner tells CNBC Make It.

As long as you meet the eligibility requirements youre able to contribute to both a 401k and Roth IRA. 1 Unlike Roth 401 ks.

Roth 401 K S Vs Traditional 401 K S Which One Is Right For You Money Under 30

Roth 401 K S Vs Traditional 401 K S Which One Is Right For You Money Under 30

What Is The Difference Between A 401k And Ira Quora

What Is The Difference Between A 401k And Ira Quora

/GettyImages-91837283-49f5b85ed6fd49e0973e2c6a1c37691d.jpg) Can I Fund A Roth Ira And Contribute To My Employer S Retirement Plan

Can I Fund A Roth Ira And Contribute To My Employer S Retirement Plan

:strip_icc()/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif) 2021 401 K Contribution Limits Rules And More

2021 401 K Contribution Limits Rules And More

/saving-in-both-a-401-k-and-a-roth-ira-7ac553decd2e4812b68d8c7c64c5434b.png) Saving In Both A 401 K And A Roth Ira Can Be A Good Idea

Saving In Both A 401 K And A Roth Ira Can Be A Good Idea

Roth 401k Limits 2020 401 K Contribution Limits For 2020 Vs 2021

Roth 401k Limits 2020 401 K Contribution Limits For 2020 Vs 2021

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Or Ira How To Choose Where To Put Your Money Ellevest

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

401 K Vs Traditional Ira Vs Roth Ira Vs Myra Human Interest

401 K Vs Traditional Ira Vs Roth Ira Vs Myra Human Interest

How To Choose Between A Traditional And Roth 401 K

How To Choose Between A Traditional And Roth 401 K

What Is A 401 K Traditional Vs Roth Rules Of Each Plan Money Tip Central

High Earners To Roth 401 K Or Not Greenleaf Trust

High Earners To Roth 401 K Or Not Greenleaf Trust

Roth Ira Vs Roth 401 K 5 Primary Differences C H Dean

Roth Ira Vs Roth 401 K 5 Primary Differences C H Dean

401 K Vs Ira How To Decide Human Interest

- Get link

- X

- Other Apps

Comments

Post a Comment