Paying More For A House Than Appraised Value

- Get link

- X

- Other Apps

So its common for an investor to pay more than the appraised value for a house. In addition the homes market valuation is often much more subjective because its largely based on the buyers opinion of the property.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/House-for-sale-8966752e99a04eb7bc7eff18c07ac740.jpg) Why Buyers Pay More Than List Price For A Home

Why Buyers Pay More Than List Price For A Home

Though theres no law against paying more than a propertys appraised value mortgage lenders almost never loan more than that value.

Paying more for a house than appraised value. The buyer can increase their down payment to make up the difference. If you have an old home which you bought at 100000 30 years ago it could carry a higher market value today at 250000. What the lender is concerned about is the ratio of the loan to the appraised value of the home not necessarily the purchase price.

Should You Buy a Home for More than the Appraised Value. It is not to your benefit to be above appraised value. Pay the difference in cash.

You could get a loan for the appraised value or a portion of it minus your down payment and then pay the remainder out of your own pocket. You can negotiate with the seller to reduce the price slightly and then make up the rest of the difference out of pocket. In a typical real estate scenario the home will be appraised after the buyer has made an offer and the seller accepts that offer.

Appreciation inflation and time will more than compensate for paying a little over the appraised price today. Typically the appraisers report will be available in less than a week. The simple answer is no.

You can pay the full difference between your offer and the appraised value out of. Is it a good idea to pay more than the appraised value of the house. If the difference is too large though it may not make sense to do so.

But it can also work the other way. Last years property values increased about 6 percent. The simple solution in your case is for the buyer to make up the difference with cash in the down payment.

The bottom line is that you can purchase a home for more than the appraised value. Even if you priced your home based on the results of your own pre-appraisal theres no guarantee that the buyers appraisal number will match. This is a less appealing solution from the buyers perspective because you are basically paying more for a home than its currently worth.

As others here have pointed out if the appraised value falls short of the agreed-upon purchase price and you still want to buy then youre going to have to come up with the difference in cash. If youre buying a distressed home by a major architect at a bargain and planning to fix it up you may well want to pay more than appraised value because it will be worth much more once its restored assuming you do it properly. This clause states that if the home were to appraise lower than the stated purchase price the buyer would bring money above appraised value OR make up the entire difference between the appraised value and purchase price.

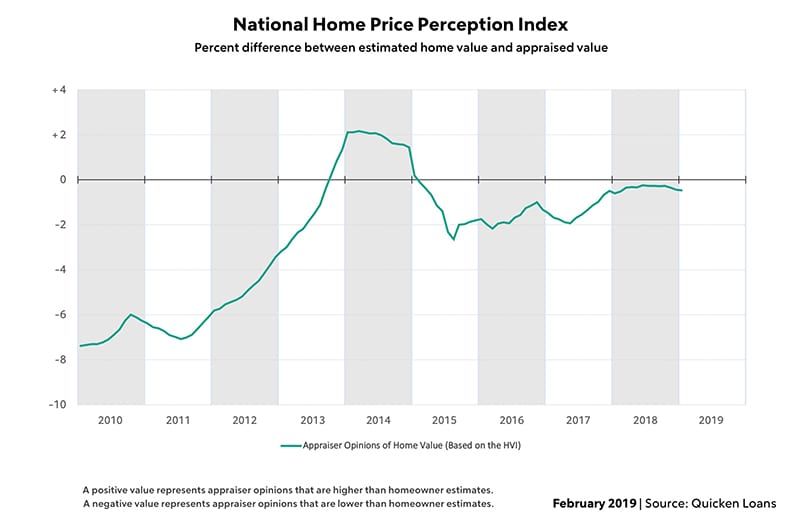

Lenders will not give a loan on a home above appraised value and most buyers will not pay more than appraised value. That being saidappraisers do all have their own opinion of value so there can be a little wiggle room. This is especially true in a fast-moving market where there are more buyers in line behind you.

Of course there are exceptions. In some cases offering to pay less than the appraised value will simply cause the home to slip through your fingers. If they estimate the home is not worth the asking price but you still wish to pursue the sale your lender will probably lend no more than the appraised value and as a result will likely require you to pay the difference between the asking price and the appraised value.

The problem with selling your home for more than the appraised value is that banks and other lenders will only loan up to a certain amount and not over the banks appraised value. When intending to stay in the property for a long time paying 1 to 5 percent over the appraised price will likely be insignificant 10 to 20 years from now. Granted most investors pay cash and dont need the approval of.

The higher your homes assessed value the more youll pay in tax. Problems when selling a house for more than the appraised value. In their view its still a good investment because they can turn around and sell it for even more money a few years down the road.

With home market values plummeting in recent years its not uncommon to see replacement costs higher than the value of the property. Make sure you give it careful consideration before you do this. If the buyers appraisal report is lower than the agreed-upon purchase price the lender wont approve the financing as-is.

This is the option we spoke about above. Appraisal Gap Guarantee Clause. If its only a small difference it might be acceptable.

For example if the buyer needed the appraisal to come in at 300000 but it comes in at 290000 the buyer can pay the 10000 difference in cash. Put simply the appraised value and the market value of a property are sometimes different from one another because as you can see from the above lists they are determined by different factors. In cases in which a propertys appraised value.

You can check with your local tax assessor for a more exact tax date for your home or. This is what confuses most homeowners. You can ask the seller to accept the appraised value of the home.

Market Vs Appraised Value In Real Estate What Do They Represent

Market Vs Appraised Value In Real Estate What Do They Represent

Should You Pay More Than The Appraised Value Of A Home

Should You Pay More Than The Appraised Value Of A Home

Should I Pay More Than The Appraised Value Of The House Youtube

Should I Pay More Than The Appraised Value Of The House Youtube

The Appraisal Came In Low Now What Zillow

The Appraisal Came In Low Now What Zillow

Should You Ever Pay More Than Appraised Value For A Home Piper Partners

Should You Ever Pay More Than Appraised Value For A Home Piper Partners

:max_bytes(150000):strip_icc()/how-to-deal-with-a-low-appraisal-1798414-finalv2-ct-2749c7a7868c442c8926425773e62027.png) How To Deal With A Low Appraisal

How To Deal With A Low Appraisal

The Home S Appraisal Value Is Less Than My Offer Now What

The Home S Appraisal Value Is Less Than My Offer Now What

Multiple Offers Paying Above The Appraised Value

Mortgage Appraisals And Appraised Value The Truth About Mortgage

Mortgage Appraisals And Appraised Value The Truth About Mortgage

/loan-to-value-ratio-315629_FINAL_v2-6fd1a550be4f4cd19dd4eea140143f44.png) Loan To Value Ratio What It Is And How To Calculate It

Loan To Value Ratio What It Is And How To Calculate It

Your Dream Home Appraised Lower Than Your Offer Now What

Your Dream Home Appraised Lower Than Your Offer Now What

Multiple Offers Paying Above The Appraised Value

Multiple Offers Paying Above The Appraised Value

Can A Seller Back Out If The Appraisal Is Higher Than The Offer Clever Real Estate

Can A Seller Back Out If The Appraisal Is Higher Than The Offer Clever Real Estate

My Home Appraisal Came In Too Low Now What

My Home Appraisal Came In Too Low Now What

Comments

Post a Comment