How Often Should You Apply For A Credit Card

- Get link

- X

- Other Apps

If you have bad credit however your best bet. If you apply more often the repeated hard inquiries into your credit history will hurt your credit score.

How Often Should You Use Your Credit Card To Keep It Active

How Often Should You Use Your Credit Card To Keep It Active

Set all credit cards to autopay in full and forget them.

How often should you apply for a credit card. While hard inquiries have a negative impact on your score the effect youll see depends on the number of. Ideally being a new entrant in the credit industry you can apply for a new credit facility right now. My rationale is to only apply for credit cards based on my ability to hit the minimum spend requirement to get the signup bonus.

As a general rule you should try use your credit card at least every one to three months to keep your account open and active and to ensure your credit card issuer continues to send updates to the credit bureaus. How often should you apply for a new credit card. New credit inquiries account for 10 of your credit score and stay on your credit report for two years.

Apply for a new credit card when you can take advantage of a large sign-up bonus. If you have several credit cards it can be tough keeping them active without running. It takes time to build the reputation and gain a good credit score.

The last time I applied for one was Jan 07. Its best to apply for a credit card about once per year assuming you need or want a card in the first place. And you shouldnt apply for more than one card at the same time.

For me this means that I apply for a new card every 3-4 months. Citi only allows one new Citi credit card application every eight days and you cannot apply for more than two Citi credit cards within a 65-day window. The top rewards credit cards offer competitive sign up bonuses worth hundreds of dollars to new customers.

Set a calendar reminder for yourself once every six months to do a sweep of your credit card statements to make sure you used them all at least once in the last six months. Most issuers allow 90 days of inactivity but some go as far as two years. 0 APR cards to consider Citi Simplicity Card.

And some issuers have policies regarding how frequently you can request a credit limit increase. Ad Search Faster Better Smarter Here. I only have this card MasterCard and am an auth user on a Macys card my mom has.

So start taking credit facility after a gap of 06 months to ensure that your new credit application can be accepted. Hi Everyone I am working towards rebuilding my credit and wanted to know how often should I apply for a new credit card. Best for a 21-month 0 introductory APR period on balance transfers All transfers must be completed in first 4 months from account opening.

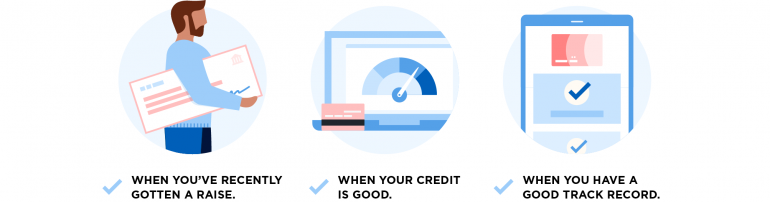

Its really up to them Lynch said. For example if you have an American Express card you can request a credit limit increase once your account has been open for at least 60 days. The Citi 865 rule specifies that you have to wait at least eight days after applying for a personal Citi card to apply for new one and that you cant apply for more than two cards within a 65-day.

If you want to apply for credit cards make sure you are doing it correctly. You are also limited to one Citi business. To earn a bonus however youll have to meet a minimum spend requirement within three months from account opening.

Here is my advice on how often you should apply for a credit cardSUPPORT THE CH. Ultimately your credit score may even rise when you open a new credit card account especially if you have a limited credit history or were using more than 30 of your existing credit lines before you got the new card. Waiting about six months between credit card applications can increase your chances of getting approved.

Apply more frequently than that and issuers may. I mainly choose cards based on my travel plans. If you have good credit you can probably get away with submitting another credit card application within three months or less.

After that the variable APR will be 1474 2474 based on your creditworthiness. What Happens When You Apply for a Credit Card. However anyone who incurs debt or misses payments as a direct result of opening too many credit cards has certainly made a.

How Often Should You Use Your Credit Card. Make sure you contact your credit card issuer to find out how long of an inactivity period it allows before closing your account said Igor Mitic a financial advisor at the online personal finance website Fortunly. This way you wont have to keep track of multiple due dates.

Ad Search Faster Better Smarter Here.

How Often Should You Apply For A New Credit Card Youtube

How Often Should You Apply For A New Credit Card Youtube

Should You Use One Credit Card To Pay Off Another Forbes Advisor

Should You Use One Credit Card To Pay Off Another Forbes Advisor

When Should You Apply For A Credit Card Smartasset

When Should You Apply For A Credit Card Smartasset

Free Download How Often Should You Apply For A New Credit Card Mp3 With 13 26

Free Download How Often Should You Apply For A New Credit Card Mp3 With 13 26

How Often Should You Apply For A New Credit Card 2019 Youtube

How Often Should You Apply For A New Credit Card 2019 Youtube

How Often Should You Use Your Credit Card Cryptoandfire

How Often Should You Use Your Credit Card Cryptoandfire

How Often Should I Apply For A New Credit Card Youtube

How Often Should I Apply For A New Credit Card Youtube

How Often Can You Open New Credit Card Accounts Us News

How Often Can You Open New Credit Card Accounts Us News

How Often Should You Apply For A New Credit Card Youtube

How Often Should You Apply For A New Credit Card Youtube

/denied-credit-card-application-960247-v1-0aa7e53830ea4a508ab8366f8d5bde26.png) Possible Reasons A Credit Card Application Was Denied

Possible Reasons A Credit Card Application Was Denied

How Often Should I Use My Credit Card Us News

How Often Should I Use My Credit Card Us News

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

When Should I Ask For A Credit Limit Increase Nerdwallet

When Should I Ask For A Credit Limit Increase Nerdwallet

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Comments

Post a Comment