Ny 529 Account

- Get link

- X

- Other Apps

New York residents may enjoy a state tax deduction for. New Yorks direct-sold 529 college savings plan is available to residents of any state.

When youre ready to open an account heres what you can expect.

Ny 529 account. First well need some basic information. In New York the aggregate contribution limit is 520000 more than most other states. Account owners are encouraged to consult a qualified tax professional about their personal situations.

There are no age or income restrictions and you dont have to be a resident of New York. Citizen or resident alien with a verified permanent US. You never pay.

Address that isnt a post office box and valid Social Security Number or Individual Taxpayer Identification Number. Total assets in 529 plans hit an all-time high of 3524 billion as of June 30 more than 25 times what they were in 2009 and there were a record 14 million accounts. Learn more about how to open a NY 529 account.

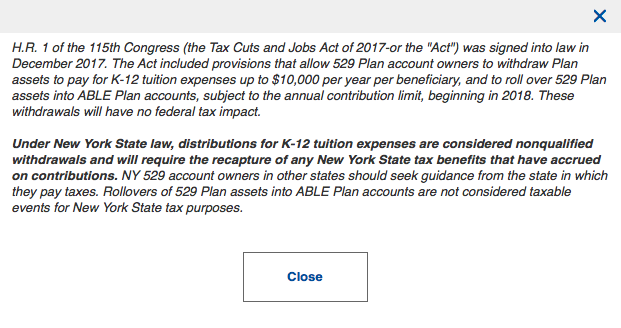

This Act is effective for distributions made after December 31 2018. Most sponsors of Section 529 plans have a place on their account application which asks you to name a contingent owner someone who would take the place of the original owner when they died. NYs 529 College Savings Program Direct Plan.

For more information about New Yorks 529 College Savings Program Direct Plan download a Disclosure Booklet and Tuition Savings Agreement or request one by calling 877-NYSAVES 877-697-2837. Please note that if you choose to open your own college savings account in the NY 529 Direct Plan you must be a US. Citizen or a resident alien with a verified permanent US.

You should read and consider them carefully before investing. Your Social Security Number or Individual Taxpayer Identification Number. Your beneficiarys Social Security Number or Individual Taxpayer Identification Number.

Morgan Investment Management Inc Ascensus Broker Dealer Services LLC JPMorgan Distribution Services Inc nor any of their applicable affiliates insures accounts or guarantees the principal deposited therein or any investment returns on any account or investment portfolio. If youre a New York taxpayer and a Direct Plan account owner you can deduct up to 5000 10000 if youre married filing jointly of your account contributions when you file your state income taxes If the childs parents invest your college savings gift in an existing 529 account you wont be able to take this deduction. If more than one account has been opened for the beneficiary this is the total for all accounts.

Open a NYSAVES 529 College Savings Account Learn who administers the NYSAVES Direct Plan and Advisor Plan For more information visit NYSAVES or call 1-877-697-2837. Both you and your child must have a valid Social Security Number or Individual Tax Identification Number to open an NY 529 Direct Plan account. Excess contributions will be returned to the contributor.

You can contribute for your beneficiary until the total balance of all New York Direct Plan accounts held for that beneficiary reaches 375000. What is the maximum amount that I can contribute to a 529 account. None of the State of New York its agencies the Federal Deposit Insurance Corporation JP.

College SAVE 529 Plan. Guide to opening your NY 529 account. College Foundation of North Carolina NC 529 Plan.

It offers low fees and diverse investment options featuring Vanguard mutual funds. This document includes investment objectives risks charges expenses and other information. New Yorks 529 College Savings Program currently includes two separate 529.

New Yorks 529 College Savings Program -- Direct Plan. NY 529 account owners in other states should seek guidance from the state in which they pay taxes. You must be a US.

Once the New York 529 plan account balance reaches the aggregate contribution limit no further contributions will be allowed. 529 plans are a way to pay educational and in some cases vocational expenses and you can even pay back student loans without paying taxes or a penalty on qualified withdrawals.

Question Of The Day Can Other People Contribute To My Ny 529 Direct Account Youtube

Question Of The Day Can Other People Contribute To My Ny 529 Direct Account Youtube

New York Ny 529 College Savings Plans Saving For College

New York Ny 529 College Savings Plans Saving For College

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

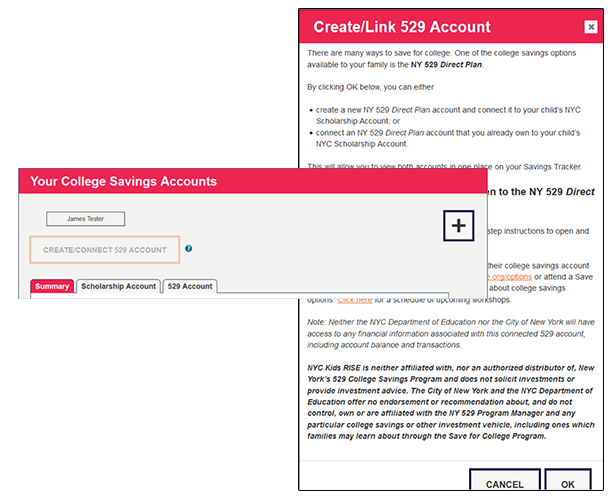

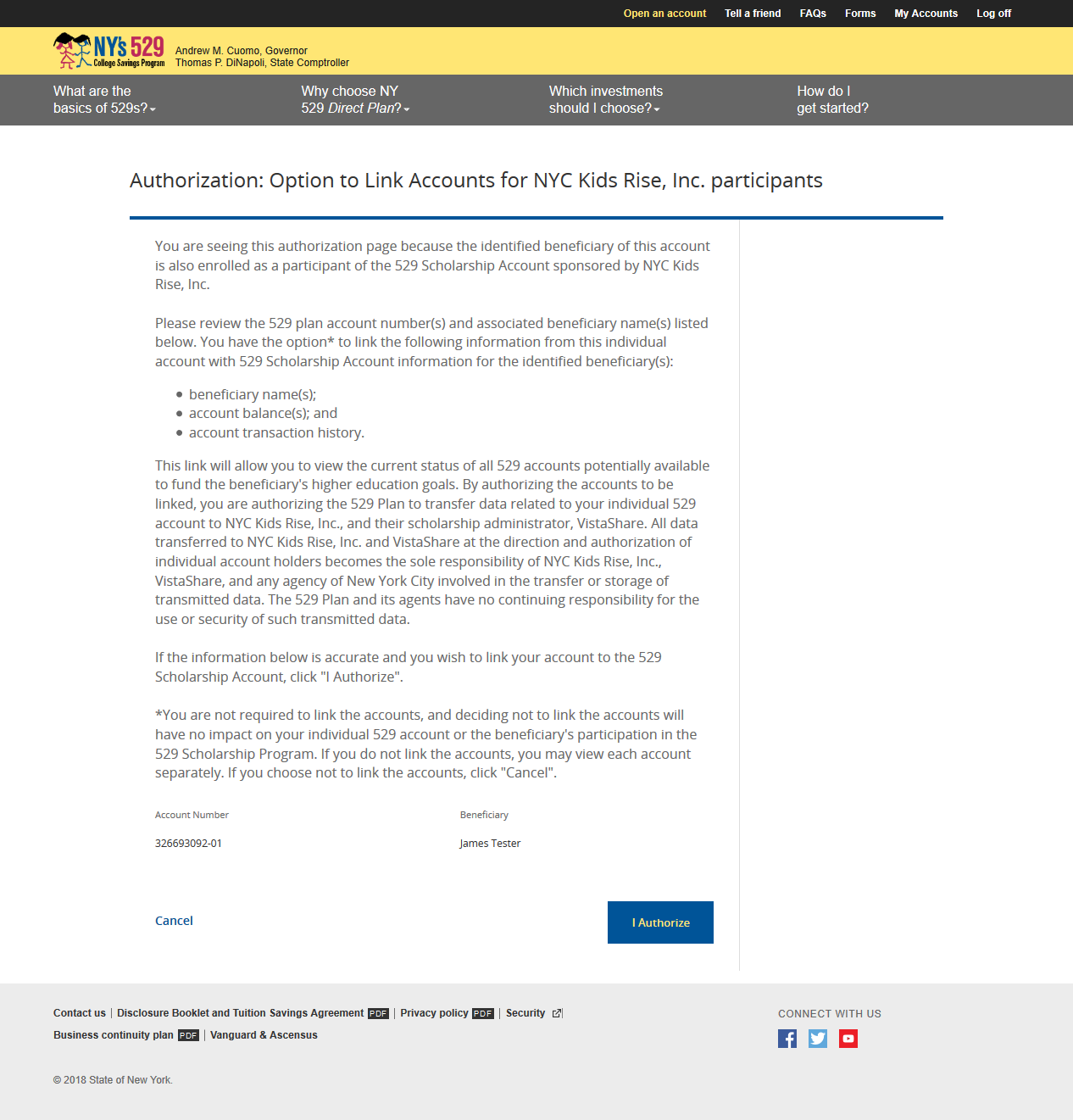

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

New York S 529 Advisor Guided College Savings Program Ny529 Advisor

New York Ny 529 College Savings Plans Saving For College

New York Ny 529 College Savings Plans Saving For College

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

New York S 529 College Savings Program Direct Plan New York 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

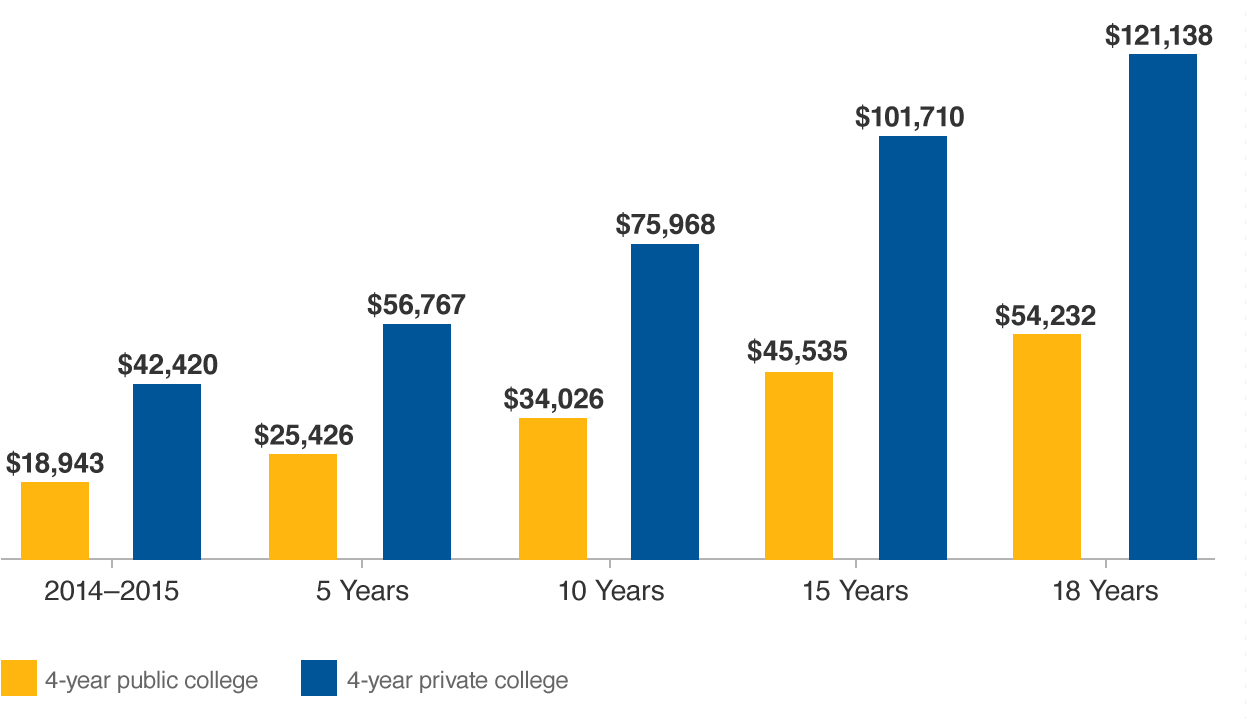

Cost Of College Ny 529 Direct Plan

Cost Of College Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

Ny S 529 College Savings Program Ny 529 Direct Plan

529 Myths The Real Story Ny 529 Direct Plan

529 Myths The Real Story Ny 529 Direct Plan

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

Avoid The Top 529 Plan Mistakes Ny 529 Direct Plan

Ny 529 Direct Plan Account Nyc Kids Rise

Ny 529 Direct Plan Account Nyc Kids Rise

Comments

Post a Comment