Higher Tax Bracket

- Get link

- X

- Other Apps

The highest tax bracket that applies to you is called your marginal tax bracket. An additional 38 bump applies to filers with higher modified adjusted gross incomes MAGI.

How Scandinavian Countries Pay For Their Government Spending

How Scandinavian Countries Pay For Their Government Spending

Has a tiered system.

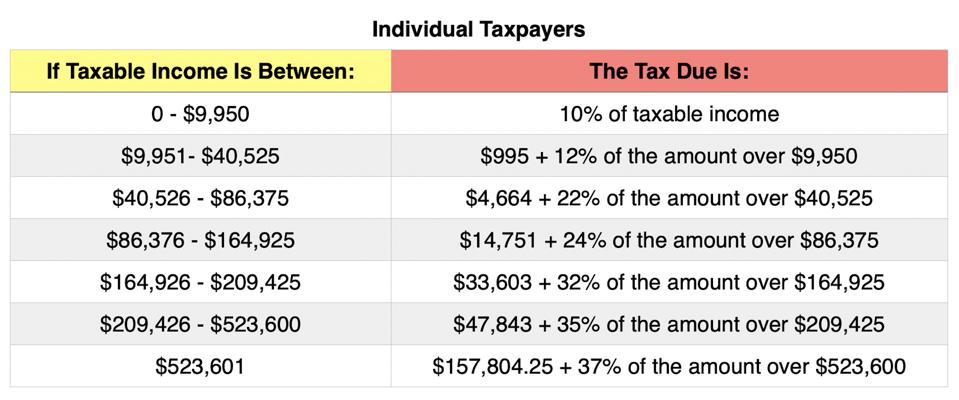

Higher tax bracket. There are seven federal tax brackets for the 2020 tax year. Tax brackets for long-term capital gains investments held for more than one year are 15 and 20. Since you dont hit the maximum in this bracket this is the percentage you should keep your eye on.

The highest bracket your income falls into without exceeding it represents your marginal tax rate. For the 202122 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100000. Your ordinary income is taxed first at its higher relative tax rates and long-term capital gains and dividends are taxed second at their lower rates.

Your bracket depends on your taxable income and filing status. If they contribute enough they can even knock themselves into a. 10 12 22 24 32 35 and 37.

Before realizing the gains your tax bill would be 400250 since the US. The IRS uses different sets of tax brackets for each type of filing status allowing for more income to be taxed at a lower rate if your filing status qualifies. If you held an investment for less than one year before selling it for a gain that is classified as a short-term capital gain and you pay the same rate as ordinary income.

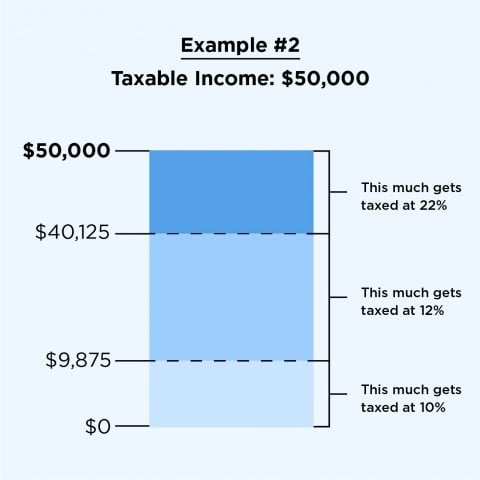

A tax bracket refers to a range of incomes subject to a certain income tax rate. So long-term capital gains cant push your ordinary income into a higher tax bracket but they may push your capital gains rate into a higher tax bracket. Its the one bracket that you cross into but dont make it out of by the end of the year.

The highest earners pay 37 percent. Tax code overhaul changed brackets deductions The tax code has seven incometax brackets with the lowest tax rate being 10 percent. Tax brackets result in a progressive tax system in which taxation progressively increases as.

Previously your highest tax bracket was 12 because your income didnt exceed 40525. This is done to prevent what is called bracket creep when people are pushed into higher income tax brackets or have reduced value from credits and deductions due to inflation instead of any increase in real income. But only 1475 of your income 42000 minus 40525 will be taxed at.

90000 annual income 48536 2nd bracket minimum 41465 x 2nd bracket rate of 205 850032 1st bracket maximum total tax of 7280. Under the federal income tax system tax bracket refers to the highest tax rate charged on your income. Now your highest tax bracket is 22.

According to the 2020 tax brackets you would have moved from the 12-percent into the 22-percent bracket which would increase your overall burden significantly. Most people in higher tax brackets will use the traditional accounts because of the tax breaks. Your total income minus your adjustments and deductions.

The IRS used to use the Consumer Price Index CPI to calculate the past years inflation. The higher tax bracket myth suggests that when income approaches a tax bracket cut-off you could earn less but have a higher take home pay. On a yearly basis the IRS adjusts more than 40 tax provisions for inflation.

Politifact Explaining Alexandria Ocasio Cortez S 70 Percent Marginal Tax Rate Idea

A Higher Tax Bracket Is Nothing To Worry About

A Higher Tax Bracket Is Nothing To Worry About

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

How Many Taxpayers Fall Into Each Income Tax Bracket Tax Foundation

How Many Taxpayers Fall Into Each Income Tax Bracket Tax Foundation

2021 Federal Tax Brackets What Is My Tax Bracket

2021 Federal Tax Brackets What Is My Tax Bracket

Historical Highest Marginal Income Tax Rates Tax Policy Center

Historical Highest Marginal Income Tax Rates Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

How Do Federal Income Tax Rates Work Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

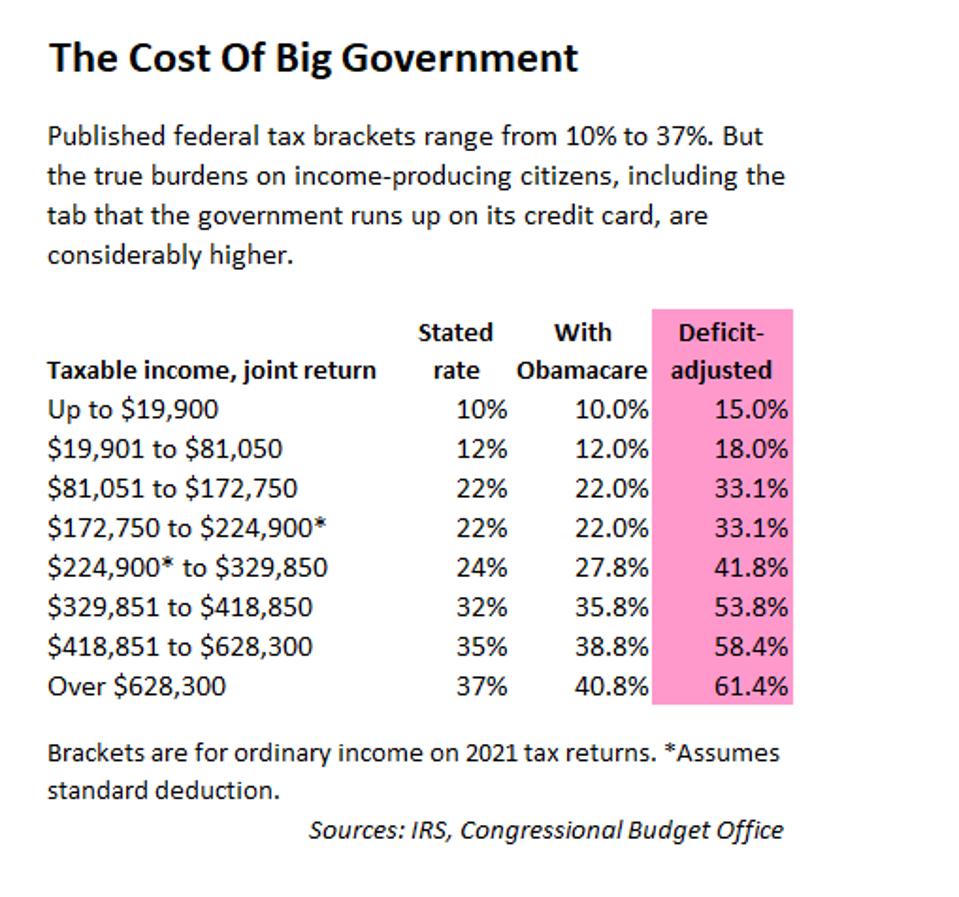

Deficit Adjusted Tax Brackets For 2021

Deficit Adjusted Tax Brackets For 2021

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Victoria News

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Victoria News

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

Taxes On The Rich Were Not Much Higher In The 1950s Tax Foundation

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

Comments

Post a Comment