Reverse Mortgage Cons

- Get link

- X

- Other Apps

Read this article to find out how. Cons to Reverse Mortgage The loan Balance Grows.

/GettyImages-1066908212-df93740a51b44601ae80a047a0e2d9dc.jpg) 5 Signs A Reverse Mortgage Is A Bad Idea

5 Signs A Reverse Mortgage Is A Bad Idea

Cons of reverse mortgages You could default and potentially lose your home if you dont meet certain requirements With a reverse mortgage you default.

Reverse mortgage cons. So it is very important that you first compare lenders and get the best rate. Over 85 Million Visitors. Over 85 Million Visitors.

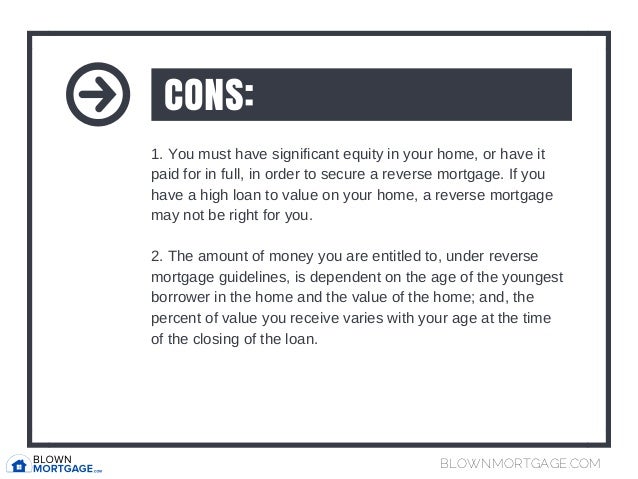

A reverse mortgage has a closing cost and there is a possibility that they can be higher than a traditional mortgage. The heir inherits the home with a lien. Reverse Mortgage Cons.

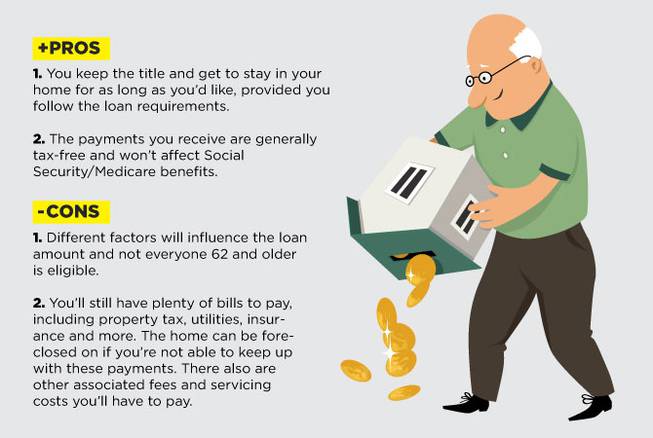

You Must Be at Least 62 If you want a reverse mortgage insured through the FHA the youngest borrower needs to be 62. A reverse mortgage is a loan and as with any type of loan there are benefits and there can be downsides. Reverse mortgages can help you with that.

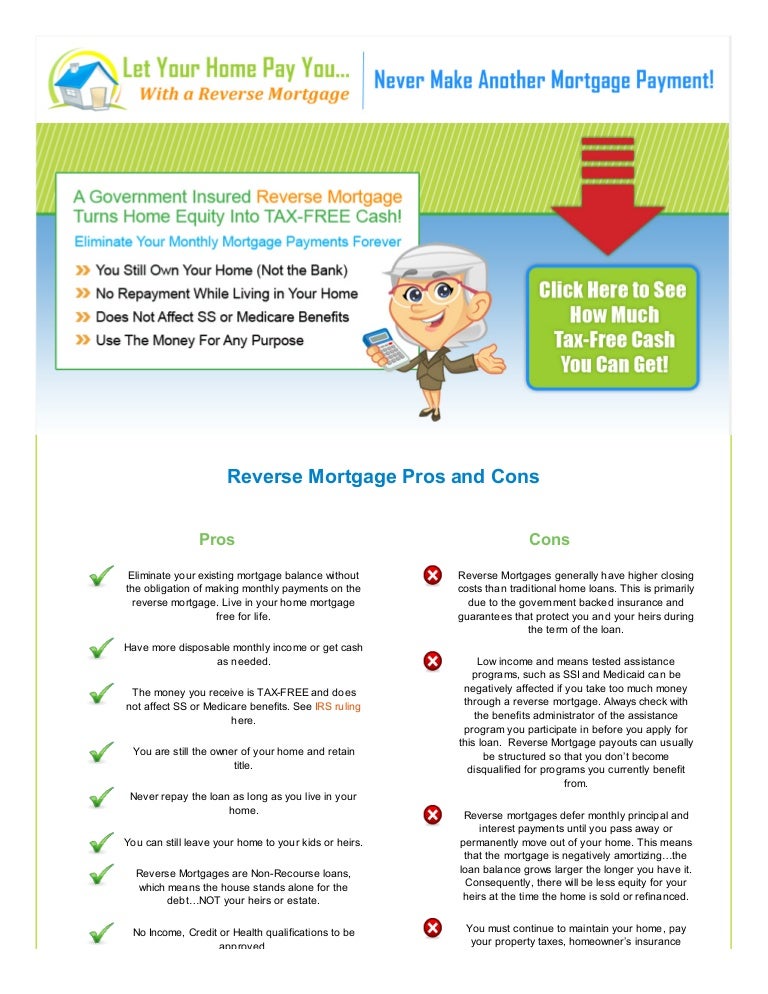

The reverse mortgage is a home loan that allows qualifying borrowers to borrow against their home equity. The Reverse Mortgage Pros and Cons in 2021 April 20 2021 By Admin no comments Theres no doubt that the decision to get a reverse mortgage can be a big one especially depending on the borrowers particular financial situation. Reverse mortgages are ideal for retirees who dont have a lot of cash savings or investments but do have a lot of wealth built up in their homes.

Reverse Mortgage Cons 1. As home equity is used fewer assets are available to leave to your heirs. You can still leave the home to your heirs but they will have to repay the loan balance.

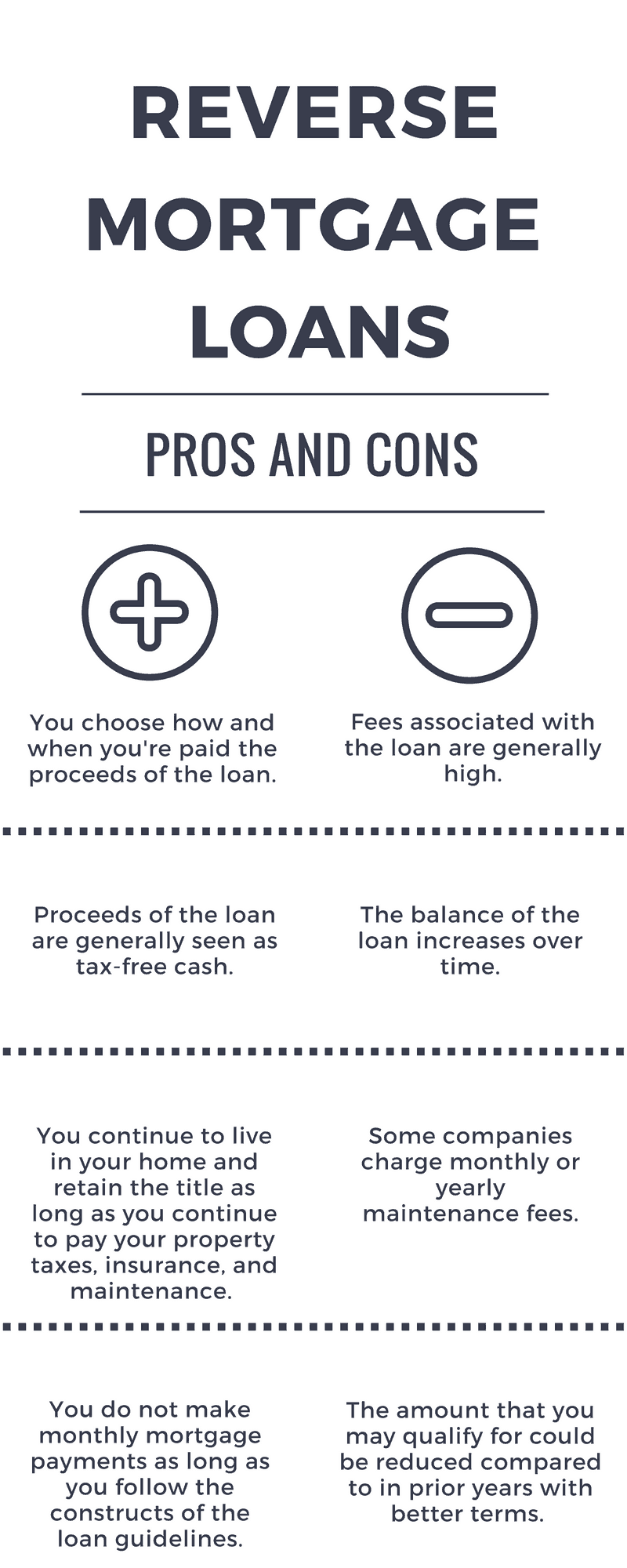

If you have a spouse that is below the age of 62 it might end up. The lien is needed to be paid off within 6 months. Reverse Mortgage Pros and Cons The biggest benefit for a homeowner is that a reverse mortgage allows them to access to useable cash.

By borrowing against an asset in this case a home itll generate cash flow to settle other debts or help pay for medical bills. With the government insured reverse mortgage HUD HECM borrowers have both 2 upfront and 50 annual renewal mortgage insurance premiums MIP to pay. CONS of a Reverse Mortgage The loan balance increases over time as interest on the loan and fees accumulate.

A reverse mortgage allows property owners 62 and older to convert real estate equity into spendable cash. A reverse mortgage allows you to turn an otherwise. By borrowing against their equity seniors get access to.

The vast majority of reverse mortgages are insured through the Federal Housing. Reverse Mortgage Cons The ability to tap into your homes equity can help pay for retirement but there are some negatives. Ad Reverse Mortgage Ohio Search Now.

In order for reverse mortgage to be insured through the FHA you cannot be younger than 62. Read this article to find out how. Here we will address some of the pros and cons associated with reverse mortgages for those qualifying individuals who are age 62 and older.

Reverse mortgages can be expensive loans due to upfront financed origination fees. A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes. The first of the reverse mortgage cons is that since there are no monthly payments on the loan the loan balance will grow.

Age limit to qualify for reverse mortgage. Even though being able to cash out your homes equity seems like a good idea it can have certain drawbacks as well. Reverse mortgages can have higher closing costs vs traditional mortgages.

This is how the homeowner is able to NOT make a monthly payment. Reverse mortgages can help you with that. Do you need a source of income to pay for your expenses after retiring.

Ad Reverse Mortgage Ohio Search Now.

What Are The Reverse Mortgage Loan Pros And Cons 5 American Advisors Group

What Are The Reverse Mortgage Loan Pros And Cons 5 American Advisors Group

Pros And Cons Of Reverse Mortgages For Seniors Benefits Of A Reverse Mortgage

Pros And Cons Of Reverse Mortgages For Seniors Benefits Of A Reverse Mortgage

Is A Reverse Mortgage Beneficial Reverse Mortgage California

Pros And Cons Of A Reverse Mortgage

Pros And Cons Of A Reverse Mortgage

Reverse Mortgage Pros And Cons For Homeowners

Reverse Mortgage Pros And Cons For Homeowners

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

6 Reverse Mortgage Disadvantages How To Avoid Them Reversemortgagereviews Org

Ask An Attorney Should I Consider A Reverse Mortgage Las Vegas Sun Newspaper

Ask An Attorney Should I Consider A Reverse Mortgage Las Vegas Sun Newspaper

What Are The Reverse Mortgage Loan Pros And Cons 1 American Advisors Group

What Are The Reverse Mortgage Loan Pros And Cons 1 American Advisors Group

Reverse Mortgage Pros And Cons

Reverse Mortgage Pros And Cons

Reverse Mortgage Pros And Cons

Reverse Mortgage Pros And Cons

Pros And Cons Of Getting A Reverse Mortgage Dokterandalan

Pros And Cons Of Getting A Reverse Mortgage Dokterandalan

Reverse Mortgage The Pros And Cons The Truth About Mortgage

Reverse Mortgage The Pros And Cons The Truth About Mortgage

What Are The Reverse Mortgage Loan Pros And Cons 2 American Advisors Group

What Are The Reverse Mortgage Loan Pros And Cons 2 American Advisors Group

Downsides Of A Reverse Mortgage Understanding Pros And Cons

Downsides Of A Reverse Mortgage Understanding Pros And Cons

Comments

Post a Comment