Is Vti A Good Investment

- Get link

- X

- Other Apps

But VTI is a great option for a long-term dollar-cost averaging. This article examines the differences between VOO and VTI and which one is likely to be a better investment.

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

However if youre even debating whether you should invest in VOO or VTI thats a good indication that you have your financial life in order.

Is vti a good investment. VTI uses a passively managed index-sampling investment strategy. The fund has exposure to small-cap stocks which can be more volatile. This means you can buy 1 share of VTI or 20 shares of.

VTI is a safe investment if you trust in the overall markets continued growth over a long amount of time. Vanguard SP 500 ETF. VTSAX has a 3000 minimum investment.

Minimum Initial Investment. VTI also offers a lower fee structure than SPY which appeals to passive index investors looking to lower investment costs. VTI looks overvalued at recent prices.

Not only does it allow investors to. VTI is largely made up of Microsoft Apple Amazon Alphabet and Facebook but also provides exposure to over 3500 stocks. For those with shorter time frames investors can check out IBDs Big Picture and Stock Market Trend features to.

I believe VTI is a good investment. Our Ai fund analyst implies that there will be a positive trend in the future and the VTI shares might be good for investing for making money. You get small mid and large caps and hold companies in every major sector.

Overall Score 66 10. VTI is an ETF which means the minimum investment is only the cost of one share. Over the long term this difference does not matter at all.

VTI has had an annualized return of 76 since inception. So VTI could be a good idea for long-term buy-and-hold investors. Its large amount of holdings reflect the entire universe of investable US.

Suitable for a growth stock portfolio plus some investment income as a side benefit. VTIs annual fees were cut. Vanguard generally is a safe choice for your investment dollars since their costs are low and thats what matters in the long run.

Investing in index funds is the easiest way to maximize diversification while minimizing fees. And because all of your investment decisions will be focused on a long-term growth strategy any of these funds would be a good long-term addition to your portfolio. Since this share has.

One of the most popular index funds in the world is the Vanguard Total Stock Market ETF NYSEMKTVTI and for good reason. The Vanguard Total stock market fund VTI is a good investment for buy-and-hold investors. VTI is a total stock market fund which means youre investing in.

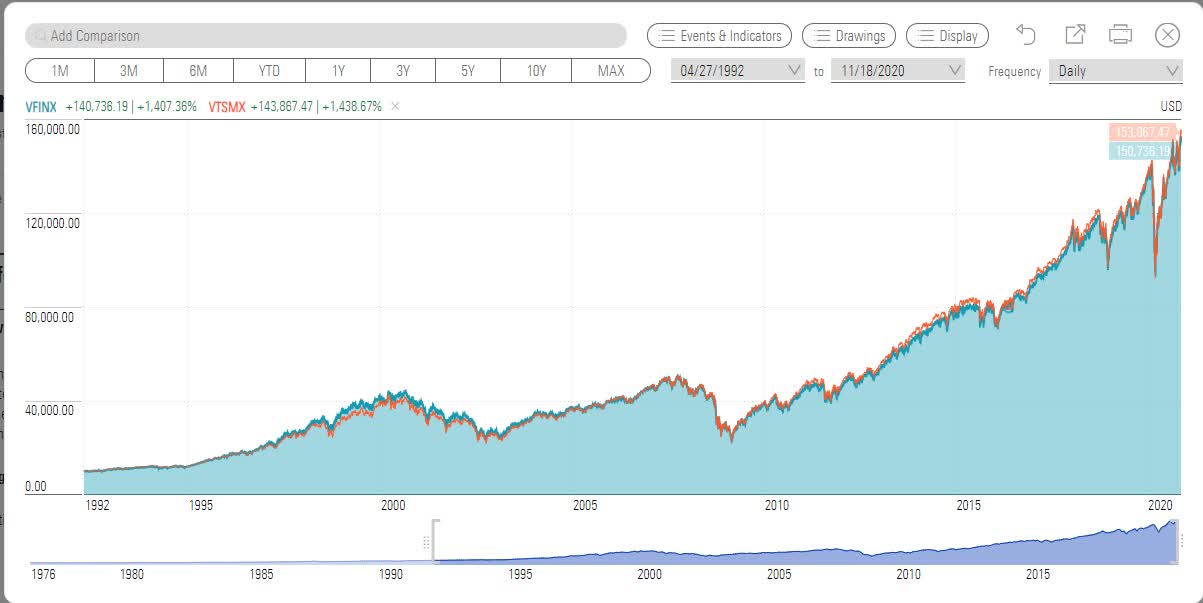

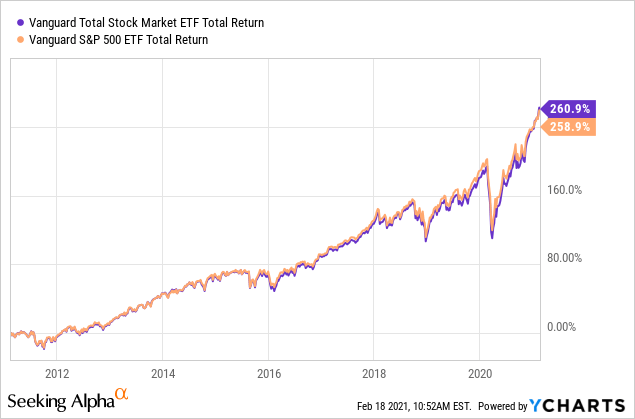

It holds 3551 stocks in total. Based on that VOO has historically been a better investment than VTI. VTI is a great choice and makes an awesome backbone to any portfolio.

This is a more diversified ETF that holds all the SP500 stocks but also many mid-cap and small-cap stocks. VTI and VOO both dont have a minimum investment it is the price of one share. However past performance is no guarantee that the same will continue to occur in the future.

VTI is an extremely diversified fund. Vanguard Total Stock Market ETF. Although for new investors 3000 is a lot of money to scrounge up for an initial investment.

Are vanguard ETFs such as VTI VGT and VOO a good investment. When the market is extremely volatile it might mean a lower share price and a higher return down the line. The fund contains over 3000 stocks which makes VTI a well-diversified portfolio.

Personally for its exposure to small market cap companies I prefer VTI which can boost growth in strong bull markets. If youre older or volatility scares you then it may be a good idea to add a bond index fund into the mix as well. If you dont want to watch an index fund accrue value over a long amount of time then theres no point to invest in one.

For this reason it is impossible to say with any certainty which one will be the better investment moving forward. Here are a few of my conclusions after completing this review of Vanguards Total Stock Market ETF. I personally prefer to invest in VTI since it offers slightly more diversification with mid-cap and small-cap stocks.

Investing exclusively in VTI will give you exposure to every publicly traded stock in the United States but it will not give you exposure to any international stocks.

Voo Vs Vti Smackdown Know How They Differ Before You Invest Nysearca Voo Seeking Alpha

Voo Vs Vti Smackdown Know How They Differ Before You Invest Nysearca Voo Seeking Alpha

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Vt Vs Vti Which Is Right For You How To Fire

Vt Vs Vti Which Is Right For You How To Fire

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

Vt Vs Vti Which Index Fund Should You Invest In Four Pillar Freedom

Voo Vs Vti Which Etf Is Better To Buy Comparing Investment Options

Is Vti A Good Long Term Investment

Vanguard Total Stock Market Etf Vti Time To Invest Etf Trends

Vanguard Total Stock Market Etf Vti Time To Invest Etf Trends

Is Vti A Good Long Term Investment

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Voo Vs Vti Which Etf Is A Better Investment Stock Analysis

Vti Is Not Really Doing Its Job Nysearca Vti Seeking Alpha

Vti Is Not Really Doing Its Job Nysearca Vti Seeking Alpha

Is Vti Etf A Good Investment Quora

Vti Review Vanguard Total Stock Market Etf Dividends Diversify

Vti Review Vanguard Total Stock Market Etf Dividends Diversify

Vt Vs Vti Which Is Right For You How To Fire

Vt Vs Vti Which Is Right For You How To Fire

Vti Review Vanguard Total Stock Market Etf Dividends Diversify

Vti Review Vanguard Total Stock Market Etf Dividends Diversify

- Get link

- X

- Other Apps

Comments

Post a Comment