How Much Will You Get From Social Security

- Get link

- X

- Other Apps

Consider the Average Social Security Payment The average Social Security benefit was 1543 per month in January 2021. For 2021 its 3895month for those who retire at age 70 up from 3790month in 2020.

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

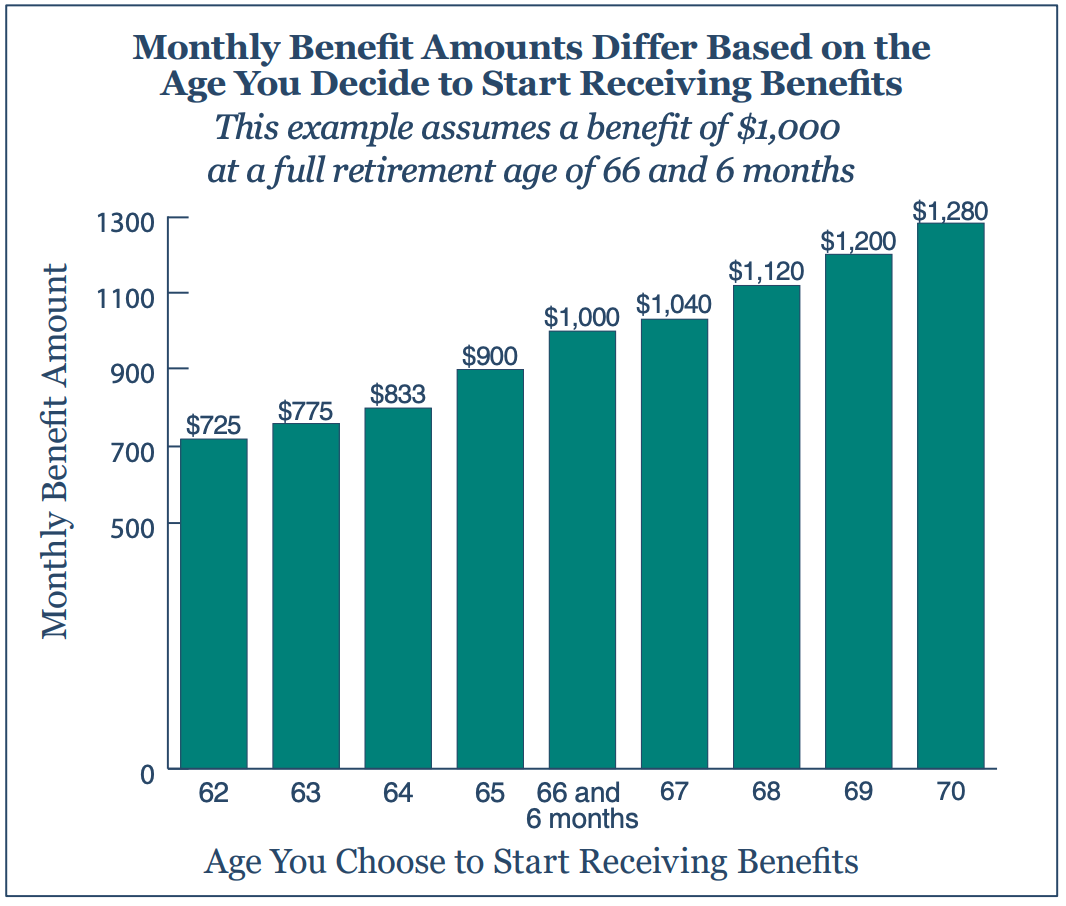

The maximum benefit the most an individual retiree can get is 3148 a month for someone who files for Social Security in 2021 at full retirement age or FRA the age at which you qualify for 100 percent of the benefit calculated from your earnings history.

How much will you get from social security. If you claim survivor benefits between age 60 50 if disabled and your full retirement age you will receive between 715 percent and 99 percent of the deceaseds benefit. Its hard to know precisely what youll earn from Social Security until you actually begin collecting payments. The maximum Social Security benefit changes each year.

The year you reach full retirement age this. If you make more than 18960 in 2021 for every 2 over the limit 1 of your Social Security benefit will be withheld. 28960 Total Wages the Social Security Income Limit of 18960 10000 Income in Excess Of Limit Because this is a full calendar year during which Rosie is receiving benefits but is not yet full retirement age the benefits reduction amount is 1 reduction for every 2 in excess wages.

Today Social Security represents about 33 of all income for older Americans. However you can work to maximize your potential payments by earning as much as you can in your pre-retirement years and delaying collection as long as possible. Instead it will estimate your earnings based on information you provide.

Benefit estimates depend on your date of birth and on your earnings history. This is 447 of your final years income. Social Security may provide 33773 If you start collecting your benefits at age 65 you could receive approximately 33773 per year or 2814 per month.

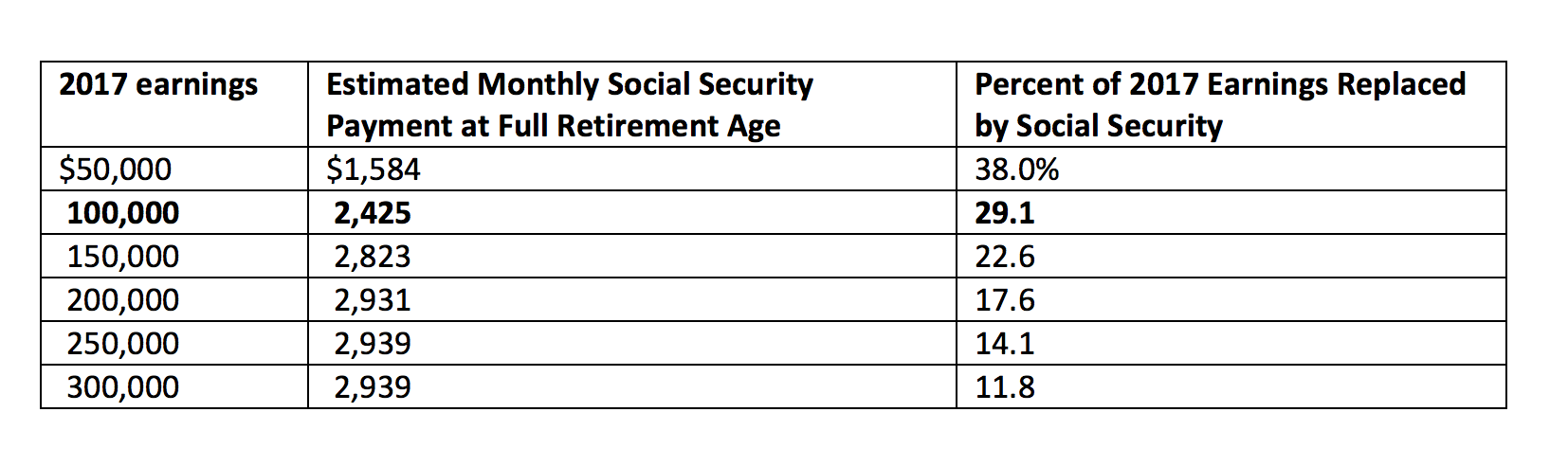

While the average Social Security benefit came to 152270 per. Social Security payments are calculated using the 35 highest earning years of your career and are adjusted for inflation. How to Calculate Your Social Security Payment.

Yes there is a limit to how much you can receive in Social Security benefits. So benefit estimates made by the Quick Calculator are rough. Until you reach full retirement age your.

If you live in the United States and you need a replacement form SSA-1099 or SSA-1042S simply go online and request an instant printable replacement form through your personal my Social Security account. Multiply that by 12 to get 46740 in maximum annual benefits. It shows the total amount of benefits you received from Social Security in the previous year so you know how much Social Security income to report to the IRS on your tax return.

If you plan to work in retirement and also collect Social Security benefits some of your benefits may be temporarily withheld based on your income. While Social Security benefits are designed to replace around 40 of your preretirement income the specific amount you receive will vary depending on. Ad Search For Relevant Info Results.

If thats less than your anticipated annual expenses. The average retired worker receives nearly 1500 a month in benefits. The percentage gets higher the older you are when you claim.

Ad Search For Relevant Info Results. For security the Quick Calculator does not access your earnings record. Get Results from 6 Engines.

Get Results from 6 Engines. Social Security Quick Calculator. However a worker would need to earn the maximum taxable amount currently 137700 for 2020 over a 35-year career to get this Social Security payment.

The size of your check will be based on your. Consider the Average Social Security Payment The average Social Security benefit was 1543 per month in January 2021.

When Should You Start Social Security Benefits Do The Math Cbs News

How Much Social Security Will I Get Forbes Advisor

How Much Social Security Will I Get Forbes Advisor

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

How Much Will I Get From Social Security If I Make 100 000 Cracsip

How Much Will I Get From Social Security If I Make 100 000 Cracsip

How Much Will I Get From Social Security If I Make 75 000 The Motley Fool

How Much Will I Get From Social Security If I Make 75 000 The Motley Fool

How Much Will I Get From Social Security

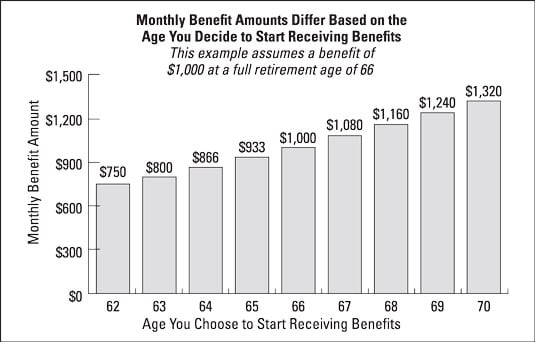

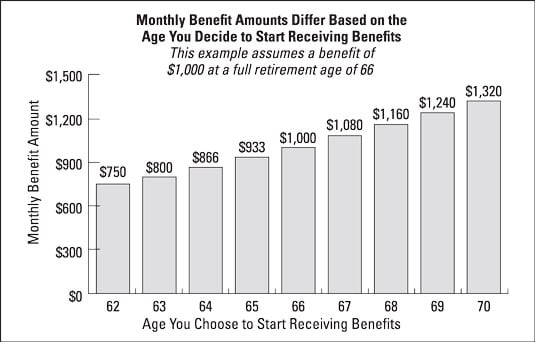

How To Estimate How Much Social Security You Ll Get Each Month Dummies

How To Estimate How Much Social Security You Ll Get Each Month Dummies

When Should You Receive Social Security

When Should You Receive Social Security

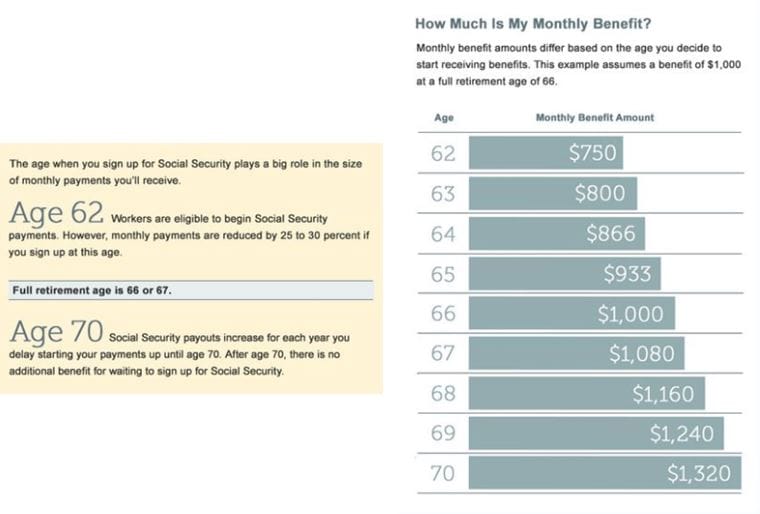

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Study Only 1 In 300 Seniors Know These 5 Social Security Rules Simplywise

Https Www Post Journal Com Life 2017 04 Social Security And What You Can Expect

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

Free Social Security Calculator Tool Estimate Your Benefits My Money Blog

How Much Can You Make While Receiving Social Security

How Much Can You Make While Receiving Social Security

Comments

Post a Comment