Interactive Marylandtaxes Gov

- Get link

- X

- Other Apps

Embracing technology and its advantages the Comptroller of Maryland offers many online services to make filing a Maryland tax return easy convenient and fast. For individuals with questions regarding income tax return filings and payments they can email taxhelpmarylandtaxesgov For taxpayers who are currently on payment plans for tax payments and who are having hardship making those payments they can email an employee in our Individual Collections Section at COVID19marylandtaxesgov.

For individual tax liabilities call 410-260-7482 260-7623 or 1-800-MD-TAXES or e-mail sutmarylandtaxesgov for either tax.

Interactive marylandtaxes gov. You can make your individual tax payment online or by telephone through one of the providers listed below. If you file your return electronically by April 15 you have until April 30 to make the credit card payment. For business tax liabilities call 410-767-1601.

Comptroller Franchot announces work group to examine pandemic spending Click on the News drop down menu to read details in the press release Revised Individual forms for Tax Year 2020 are available nowSelect 2020 Income Tax Forms from the Forms drop down menu or link from the RELIEF Act Page BREAKING NEWS. Ad State Governments May Have Up To 40 Billion In Unclaimed Money - Is Some Of It Yours. Contact 1-800-MD TAXES 1-800-638-2937 or taxhelpmarylandtaxesgov.

Simply complete your tax return save the forms and all supporting schedules in pdf format and send it as an attachment to ALCOHOLMARYLANDTAXESGOV. For assistance users may contact the Taxpayer Service Section Monday through Friday from 830 am until 430 pm by calling 410-260-7980 from central Maryland or 1-800-MDTAXES 1-800-638-2937 from elsewhere. You may attach the return in a single pdf file preferred or multiple pdf files as long as the total size of the email does not exceed 140MB.

Rsmithmarylandtaxesgov 6401 Golden Triangle Drive Suite 100 Greenbelt MD 20770 - 3202. Smith Branch Manager 301 486-7540. However data may not be accessible during times of system maintenance.

The Maryland Comptrollers office offers many online services for Maryland businesses. You can save the trip to the post office. Or you may e-mail us at taxhelpmarylandtaxesgov.

Earned Income Tax Credit EITC Assistant. This capability allows businesses to obtain information and fulfill obligations outside of normal business hours of operation. Information regarding these services can be found in this section.

PRINCE GEORGES COUNTY Leonard Santek Branch Manager 301 952-2810. Lsantekmarylandtaxesgov Courthouse Bourne Wing Room 083B 14735 Main St Upper Marlboro MD 20772 - 9978 Rene D. Ad State Governments May Have Up To 40 Billion In Unclaimed Money - Is Some Of It Yours.

Taxhelpmarylandtaxesgov For technical questions and support NIC Maryland eGov Services Partner of the Department of Information Technology DoIT and Marylandgov. Businesses are often confronted with customers who wish to make purchases tax free either because they intend to resell the item and charge the sales tax or because they are making a purchase for an organization possessing a tax exempt card issued by the State Comptrollers Office. Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name.

For assistance users may contact the Taxpayer Services Division Monday through Friday from 830 am until 430 pm via email at taxhelpmarylandtaxesgov or via phone 410-260-7980 from central Maryland or at 1-800-MDTAXES 1-800-638-2937 from elsewhere. For businesses struggling to make business-related tax payments due to COVID-19 closures and restrictions they should email taxpayerreliefmarylandtaxesgov COVID-19 Tax Alert 04-14-20A COVID-19 Tax Alert 01-06-21. Most People Dont Know That The State Could Be Holding Unclaimed Money In Their Name.

If your name appears in the listing you should contact the Comptrollers Office to make arrangements to resolve the liability. Individuals can pay their Maryland taxes with a credit card. The Earned Income Tax Credit EITC helps low-to-moderate income workers and families get a tax break.

This service applies to taxes owed for the current year or any back year if you have a bill. The Comptrollers Web Services Center is available 24 hours a day 7 days a week from any home office or public access point. Online Verification of Maryland Tax Account Numbers.

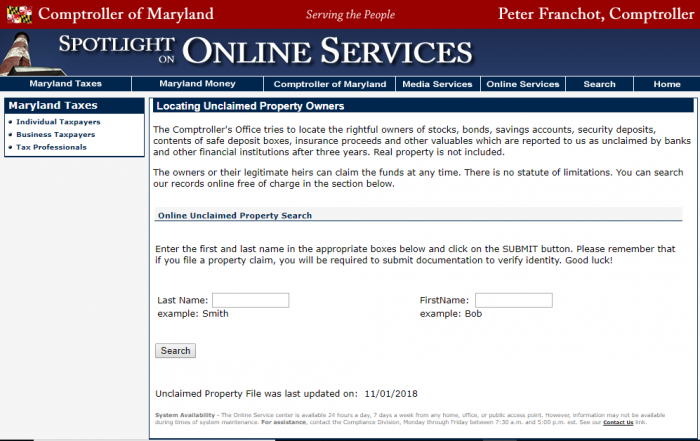

Additionally the agencys other online service for tax bill paying unclaimed property searches and hearing requests can be found in this section.

Ifile Demo Maryland S Internet Tax Filing For 2019

Ifile Demo Maryland S Internet Tax Filing For 2019

How To Find Your W Number For Sps Workday Kb

How To Find Your W Number For Sps Workday Kb

Maryland Unclaimed Money 2021 Guide Unclaimedmoneyfinder Org

Maryland Unclaimed Money 2021 Guide Unclaimedmoneyfinder Org

Interactive Marylandtaxes Com Website Marylandtaxes Gov Welcome To The Office Of The Comptroller

Interactive Marylandtaxes Gov Analytics Market Share Data Ranking Similarweb

Interactive Marylandtaxes Gov Cross Site Scripting Vulnerability Open Bug Bounty Website Vulnerabilities Openbugbounty Org

Interactive Marylandtaxes Gov Cross Site Scripting Vulnerability Open Bug Bounty Website Vulnerabilities Openbugbounty Org

Interactive Marylandtaxes Gov Analytics Market Share Data Ranking Similarweb

Comptroller Of Maryland Shopmd On Twitter Comptroller Franchot Has A Very Particular Set Of Skills Including Reuniting You With Unclaimed Property Search The Online Database Here Https T Co H09ky8sl0h Https T Co Tfcme3u0n8

Comptroller Of Maryland Shopmd On Twitter Comptroller Franchot Has A Very Particular Set Of Skills Including Reuniting You With Unclaimed Property Search The Online Database Here Https T Co H09ky8sl0h Https T Co Tfcme3u0n8

Marylandtaxes Gov Welcome To The Office Of The Comptroller

Marylandtaxes Gov Welcome To The Office Of The Comptroller

Interactive Marylandtaxes Com Marylandtaxes Gov Welcome To Interactive Marylandtaxes

Interactive Marylandtaxes Com Marylandtaxes Gov Welcome To Interactive Marylandtaxes

- Get link

- X

- Other Apps

Comments

Post a Comment