Average Credit Line

- Get link

- X

- Other Apps

Heres what you need to know about business line of credit rates. The Consumer Financial Protection Bureau reported average credit lines per account broken down by FICO score range.

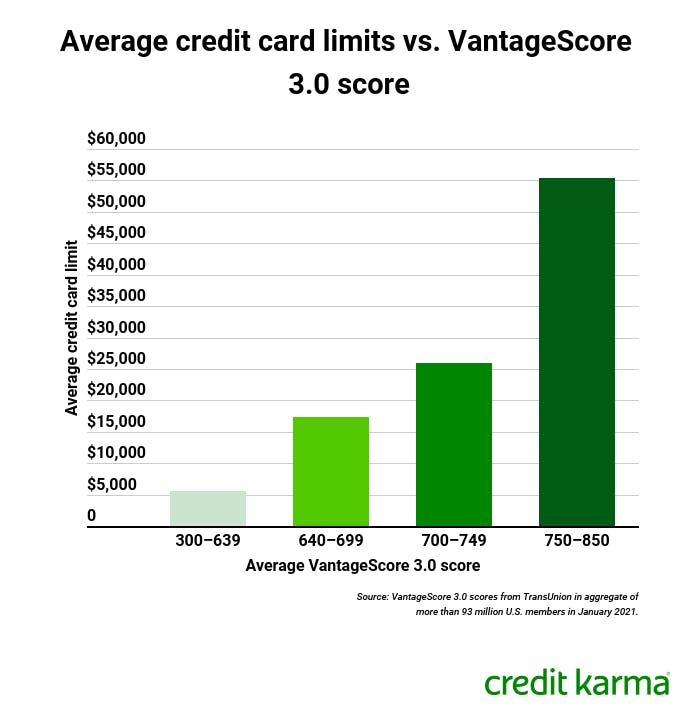

What Is A Credit Limit And How Is It Determined Credit Karma

What Is A Credit Limit And How Is It Determined Credit Karma

Again whether 10k is a high limit really depends on your experience and needs.

Average credit line. Average Rate for Business Lines of Credit By Lender Type. The average interest rate on a HELOC or home equity line of credit is 429 for a 50000 loan with an 80 loan-to-value ratio according to data from SP Global. Kabbage credit line review.

If you want a revolving line of credit thats above 100 - 100000 and a term longer than 12 or 24 weeks Fundbox isnt right for you. In your case expect no more than 1000. Credit line 5000 balance 1000.

Typically the credit limit is equal to 75 or 80. However Chase will waive the fee if your average credit utilization is 40 or higher. The bureau finds the mean length of credit history for all your open accounts.

Average credit today is pretty good you wont get a lot of the advantages but you have options. According to Nav these are the business line of credit rates for 2019. Additional purchases also called promotions may accrue interest at a different rate than other purchases.

Recent data from Experian suggests that the average American consumer has access to 31015 in credit limits across all of their. The interest rate youll receive is dependent on several factors including your banking relationship with Chase your credit history and what collateral you have. Heres what the agency found.

Credit line 8000 balance 4000. Prime rate plus 125. Thats relatively unchanged from December 2015 when the average credit card limit was 8042.

Revolving line-of-credit which acts similarly to a credit card where additional purchases can be opened using the same line-of-credit. What is considered a normal credit limit among most Americans. SBA line of credit.

Additionally the company does cap the initial draw at 40000 meaning even if you do get approved for a 100000 credit line. The Average Credit Card Limit. You might qualify for deals and teaser rates but dont fall into the trap of running a balance and paying interest at double-digit rates over long periods.

The average credit limit for super-prime consumers is 11000 and 1200 for subprime consumers. Average credit limits Data from credit bureau Equifaxs Credit Trends report shows that the average credit limit for new bank card originations brand. Bank customers may want to take advantage of its line of credit.

A HELOC is secured by the market value of the home minus the amount owed which becomes the basis for determining the size of the line of credit. Any line higher than 10000 is considered above average for consumers with the best credit scores. This blog post will explain how Average Daily Balance is calculated in revolving line-of credit.

Some high-net-worth individuals with excellent credit can have six-figure credit limits or no preset spending limits at all. As youll see below there is a wide range in credit card limits because consumers with low credit scores cant access high limits. It could be as low at 200 for someone young with no history or as high as 30000 for someone with decades of good credit.

Typically its easier to qualify for the best rates in a booming economy than a difficult one. Credit age on the other hand refers to an average. Credit line 10000 balance 2500.

While limits may vary by age and location on average Americans have a total credit limit of 22751 across all their credit cards according to the latest 2019 Experian data. A credit line between 500 and 25000 and an annual fee of just 25 per card. According to Experian data the average credit card limit as of December 2016 was 8071.

In short your credit age is used to calculate the 15 of your score thats tied to your length of credit history. Theres no annual fee plus the variable APR is currently set at 1175. Chase business lines of credit do have an annual fee.

There really is no meaningful average. Interest rates and fees on credit cards tend to be high with an average rate around 20 APR. These individuals have higher credit limits because of their outstanding credit history and ability to repay high balances.

Credit Card Limit Can We Suggest

Credit Card Limit Can We Suggest

Average Credit Card Limit Mintlife Blog

Average Credit Card Limit Mintlife Blog

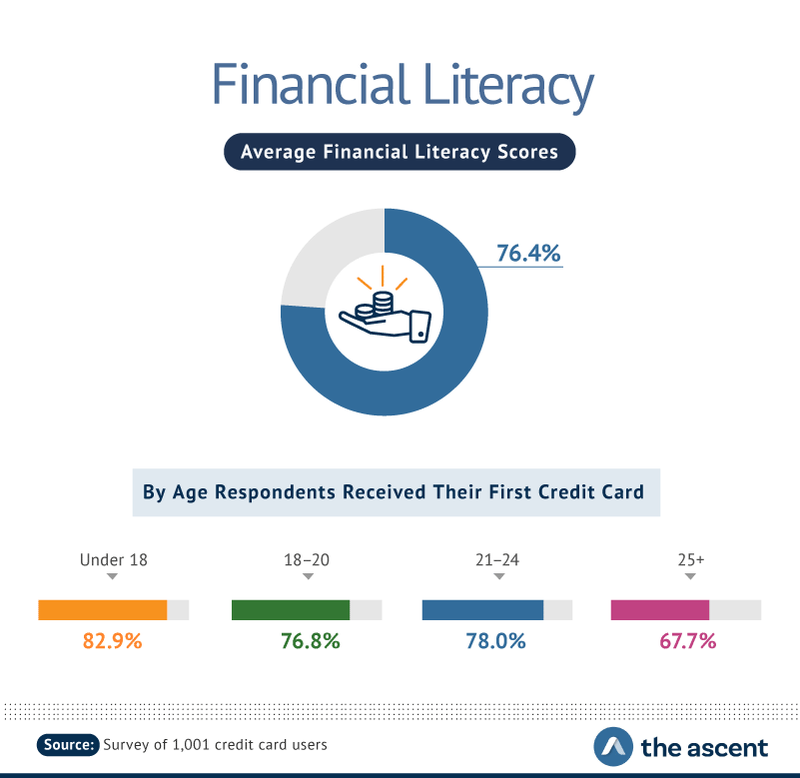

When Does The Average American Get Their First Credit Card The Ascent

When Does The Average American Get Their First Credit Card The Ascent

What S The Average Credit Limit Personal Finance Money Stack Exchange

What S The Average Credit Limit Personal Finance Money Stack Exchange

What S The Average Credit Limit Personal Finance Money Stack Exchange

What S The Average Credit Limit Personal Finance Money Stack Exchange

9 Biggest Drawbacks Of Store Credit Cards Reviews By Wirecutter

9 Biggest Drawbacks Of Store Credit Cards Reviews By Wirecutter

Should You Increase Your Credit Card Limit

Should You Increase Your Credit Card Limit

People With Poor Credit Scores Make These 3 Credit Mistakes Credit Sesame

People With Poor Credit Scores Make These 3 Credit Mistakes Credit Sesame

Average Revolving Credit Line Use And Average Capital Expenditure Download Scientific Diagram

Average Revolving Credit Line Use And Average Capital Expenditure Download Scientific Diagram

/howtoincreaseyourlimitonyourfirstcreditcard-07d537491b0648cdbc51438989360ca8.png) The Average Credit Limit On A First Credit Card

The Average Credit Limit On A First Credit Card

Do Credit Limit Reductions Affect Fico Scores Eliminate The Muda

Average Revolving Credit Line Use And Average Capital Expenditure Download Scientific Diagram

Average Revolving Credit Line Use And Average Capital Expenditure Download Scientific Diagram

How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Comments

Post a Comment