What Is Purchase Apr

- Get link

- X

- Other Apps

The purchase APR on a credit card tells you how much more expensive the items that you charge to your card will become over the course of a year if you carry a balance from month to month. In general purchase APR is the interest applied to any credit card purchases that arent paid off in full before the credit card grace period ends.

Annual Percentage Rate Apr Accounting

Annual Percentage Rate Apr Accounting

This rate is applied monthly unless you pay your balance in full by the payments due date.

What is purchase apr. In other words its the rate at which a balance from purchases will accrue interest on an annualized basis if you dont pay your bill in full by the due date. Purchase annual percentage rate APR is the interest applied to your credit card bill if youve got an outstanding balance that rolls over from the current month to the next. This is also referred to as the purchase APR Its the interest rate you pay for the things you buy using your credit card.

How its applied and how its. What Is Purchase Annual Percentage Rate APR. A purchase annual percentage rate or APR is the interest rate thats applied to credit card purchases.

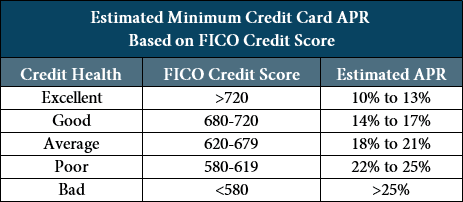

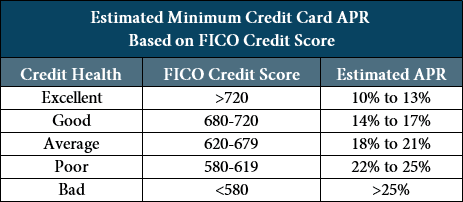

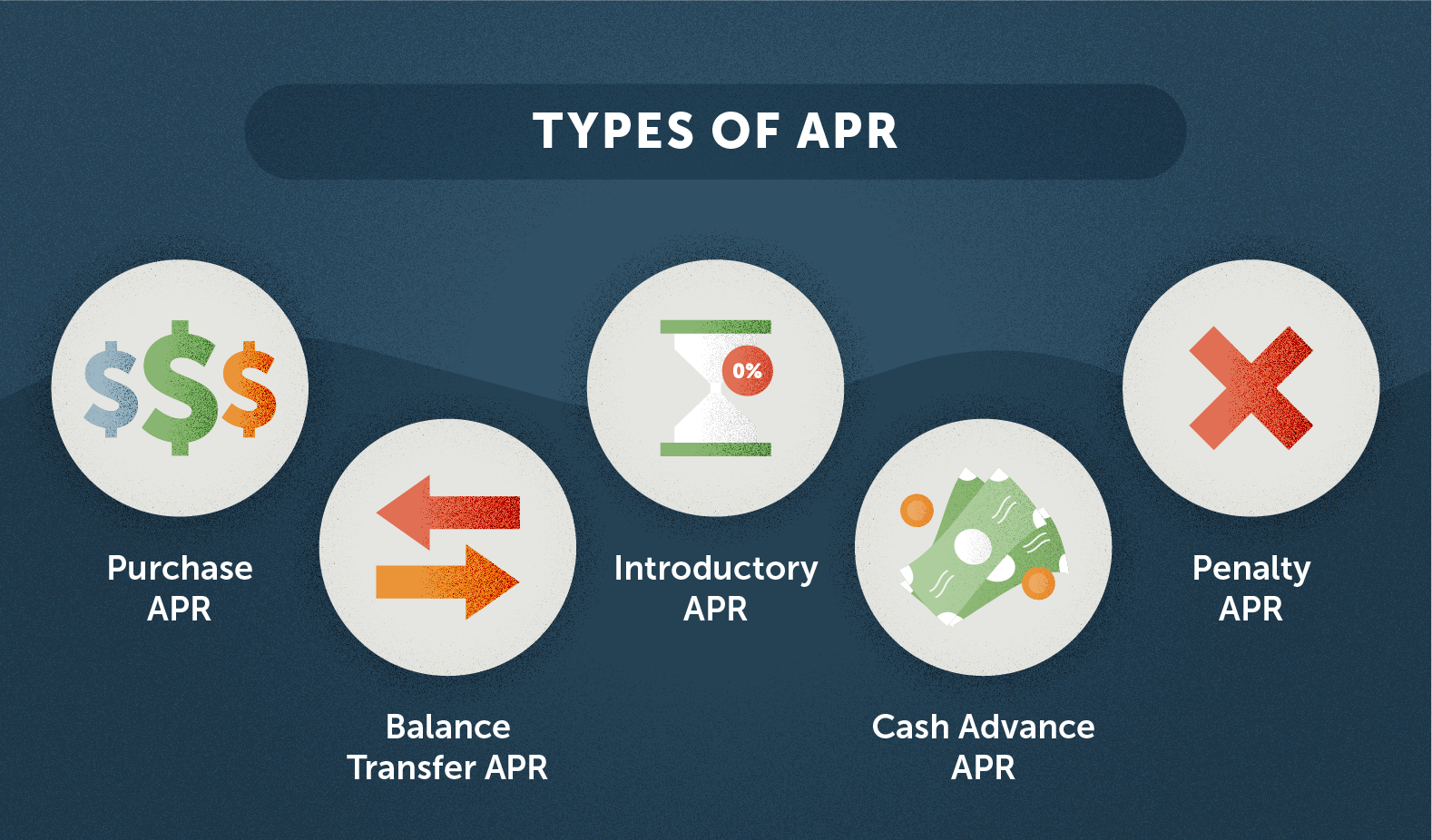

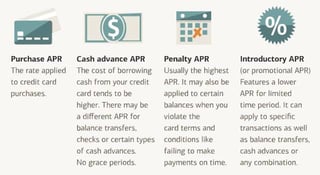

A purchase annual percentage rate or APR is the interest charge that is added monthly to the outstanding balance due on a credit card. All lenders have to tell you what their APR is before you sign a credit agreement. Note however each credit card has multiple APRs.

However there are a lot of other. The APR you pay your credit card issuer for carrying a balance on your card is usually expressed as an annual rate. This fee is known as purchase annual percentage rate.

Purchase annual percentage rate APR is the interest applied to your credit card bill if youve got an outstanding balance that rolls over from the current month to the next. The APR includes not only the interest expense on the loan but also. This interest rate typically kicks in when you carry over some of what you owe on purchases from month to month.

It is a finance charge expressed as an annual rate. For example when you use your card at a restaurant gas station or order an item online the purchase APR will be calculated on the portion of the bill that you do not pay in. When deciding between credit cards APR can help you compare how expensive a transaction will be on each one.

It takes into account the interest rate and additional charges of a credit offer. Generally APR refers to the purchase APR which is the interest youll owe on everyday purchases. You can avoid having to pay any interest at all if you pay your balance off in full every month before the next billing cycle begins.

The APR on a credit card is. The APR on a credit card is an annualized percentage rate that is applied monthly. What Is Purchase APR.

A purchase annual percentage rate or APR is the interest charge that is added monthly to the outstanding balance due on a credit card. Consequently for credit cards the APR and the interest is the same. Annual percentage rate APR is the official rate used to help you understand the cost of borrowing.

APR is an annualized representation of your interest rate. The term annual percentage rate of charge APR corresponding sometimes to a nominal APR and sometimes to an effective APR EAPR is the interest rate for a whole year annualized rather than just a monthly feerate as applied on a loan mortgage loan credit card etc. The purchase APR is the one you will be charged for the things you buy at physical and online locations.

The APR however is the more effective rate to consider when comparing loans. Credit card issuers can charge you additional interest for making purchases while carrying balances on your credit card. You may pay a different APR on cash advances and balance transfers for example and also after missing a.

Purchase APR is the interest rate that your card issuer charges you for purchases made with your card. If you pay off your full statement balance on time each month you can avoid paying any interest on those purchases. Its helpful to consider two main things about how APR works.

This rate is applied monthly unless you pay your balance in full by the payments due date.

Learn Just How To Purchase Apr Credit Rating Cards Josuekeoz982 Over Blog Com

Learn Just How To Purchase Apr Credit Rating Cards Josuekeoz982 Over Blog Com

What Is A Purchase Apr Youtube

What Is A Purchase Apr Youtube

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png) What Apr Tells You About A Loan

What Apr Tells You About A Loan

What Is Purchase Apr Credit Card Interest Rates 101

What Is Purchase Apr Credit Card Interest Rates 101

What Is A Regular Purchase Apr 2021

What Is A Regular Purchase Apr 2021

Understanding Credit Card Aprs Interest Rates Valuepenguin

What Is Credit Card Apr How Yours Affects You Mintlife Blog

What Is Credit Card Apr How Yours Affects You Mintlife Blog

How Do 0 Apr Credit Cards Work Everything You Should Know Valuepenguin

What Is Purchase Apr Smartasset

What Is Purchase Apr Smartasset

Annual Percentage Rate Wikipedia

Annual Percentage Rate Wikipedia

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr And What Exactly Do You Need To Know Lexington Law

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Apr On A Credit Card 9 Best Low Interest 0 Apr Cards

What Is Purchase Apr And How Does It Work Credit Karma

What Is Purchase Apr And How Does It Work Credit Karma

Comments

Post a Comment