What Percentage Of My Credit Card Should I Use

- Get link

- X

- Other Apps

Its commonly said that you should aim to use less than 30 of your available credit and thats a good rule to follow. But if your 2000-limit card were closed due to inactivity that would bring your utilization up to 50 percent.

How Does The Credit Utilization Percentage Impact My Credit Score

How Does The Credit Utilization Percentage Impact My Credit Score

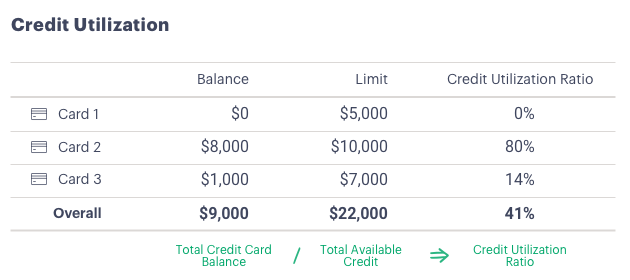

Then divide the amount of debt by the total credit card limits.

What percentage of my credit card should i use. More credit cards after that wont necessarily give you better credit scores although they can make it easier to keep your utilization low. A good interest rate on a credit card is around 14. The key is to use your credit cards responsibly no matter how many you have.

Ideally it should be 10 or less for the. Say you have two credit cards each with a limit of 5000 making your total credit limit 10000. But the lower the better.

The best utilization percentage to have is 0 because then you have no credit card debt and youre not paying interest. In fact according to FICO consumers who have scores above 760 have an average utilization percentage of 7. Shown as a percentage it represents how much credit you use your credit card balance compared to how much you have available to you your credit limit.

Your credit score will take a bigger hit once your utilization goes above that. Some credit experts say you should keep your credit utilization ratio the percentage of your total available credit you use below 30 to maintain a good or excellent credit score. You can best manage your credit utilization by keeping your credit card balances below 30 of the credit limit.

According to Experian one of the three major credit bureaus the average credit utilization ratio for a person with a credit score over 800 is 115. On the other end of the spectrum having a zero percent credit. For example that means your credit card balance should always be below 300 on a credit card with a 1000 limit.

Staying under 30 utilization will help you avoid hurting your credit scores and keeping your ratio at 6 or under will help you achieve top scores. Your credit utilization ratio the amount you owe versus your total available credit comprises 30 percent of your credit score and is the second most important factor after on-time bill payments. If you want to improve and maintain a good credit score its more reasonable to keep your balance at or below 30 of your credit limit.

People with exceptional credit scores 800 or higher on the FICO Score range of 300 to 850 tend to keep utilization under 10 for each card and for total credit card. That is roughly the average regular interest rate on credit cards for people with excellent credit. Ad Get a Card with 0 APR Until 2022.

So if you have an 800 credit card. In this case your credit utilization would be nearly 17 percent 5003000. If you have a balance of 2500 on one card and a 0 balance on the other your total balance is 2500 and your credit utilization ratio is 25.

Your credit scores can improve simply from having one credit card on your reports all other things being equal. This percentage should never be more than 30 or your credit score will get hammered. So for example if your credit card limit was 1000 you should keep your.

But theres really no magical utilization rate cutoff for every scoring model. Credit utilization is calculated by dividing your total credit card balances by your total card limits. Ad Get a Card with 0 APR Until 2022.

Ive been told by numerous experts that consumers should have a credit utilization rate of no more than 30 percent. Our Experts Found the Best Credit Card Offers for You. But since thats not realistic for everyone the best percentage is the lowest percentage you can achieve.

Even a relatively good interest rate on credit cards for people with lower scores is not all that low. For optimum credit score results the balances on your credit cards both individually and combined together should be as low as possible. While there are no hard-and-fast rules around what an ideal utilization ratio should be below 30 percent is typically recommended.

Our Experts Found the Best Credit Card Offers for You.

What Is A Credit Utilization Rate Experian

What Is A Credit Utilization Rate Experian

How Paying A Credit Card Statements Work Credit Card Insider

How Paying A Credit Card Statements Work Credit Card Insider

How Does The Credit Utilization Percentage Impact My Credit Score

How Does The Credit Utilization Percentage Impact My Credit Score

6 Simple Steps To Improve Your Credit Score

6 Simple Steps To Improve Your Credit Score

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

Max Our Credit Card Limits And Hurt Your Credit Learn Why Credit Com

Credit Utilization Ratio How It Works How To Improve It Upgrade

Credit Utilization Ratio How It Works How To Improve It Upgrade

:max_bytes(150000):strip_icc()/CalculateCardPayments4-a6570a7d2e36410b9980f4833a4f8f6e.jpg) Calculate Credit Card Payments And Costs Examples

Calculate Credit Card Payments And Costs Examples

/how-to-calculate-your-credit-utilization-ratio-960473_V1-0558528520ca4e289bc0f25535ae3e7f.png) How To Calculate Your Credit Utilization Ratio

How To Calculate Your Credit Utilization Ratio

Seven In Ten College Students Damage Credit Soon After Graduation Opploans

Seven In Ten College Students Damage Credit Soon After Graduation Opploans

Forbes Guide To Credit Cards Forbes Advisor

Forbes Guide To Credit Cards Forbes Advisor

- Get link

- X

- Other Apps

/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-05392a2855bb47a6a859e3472cbe3d83.jpg)

:max_bytes(150000):strip_icc()/credit-limit-definition-960695-v1-82b65d7e2653423cb55f871b05a0ccf1.png)

Comments

Post a Comment