How Much Can You Earn While Collecting Social Security

- Get link

- X

- Other Apps

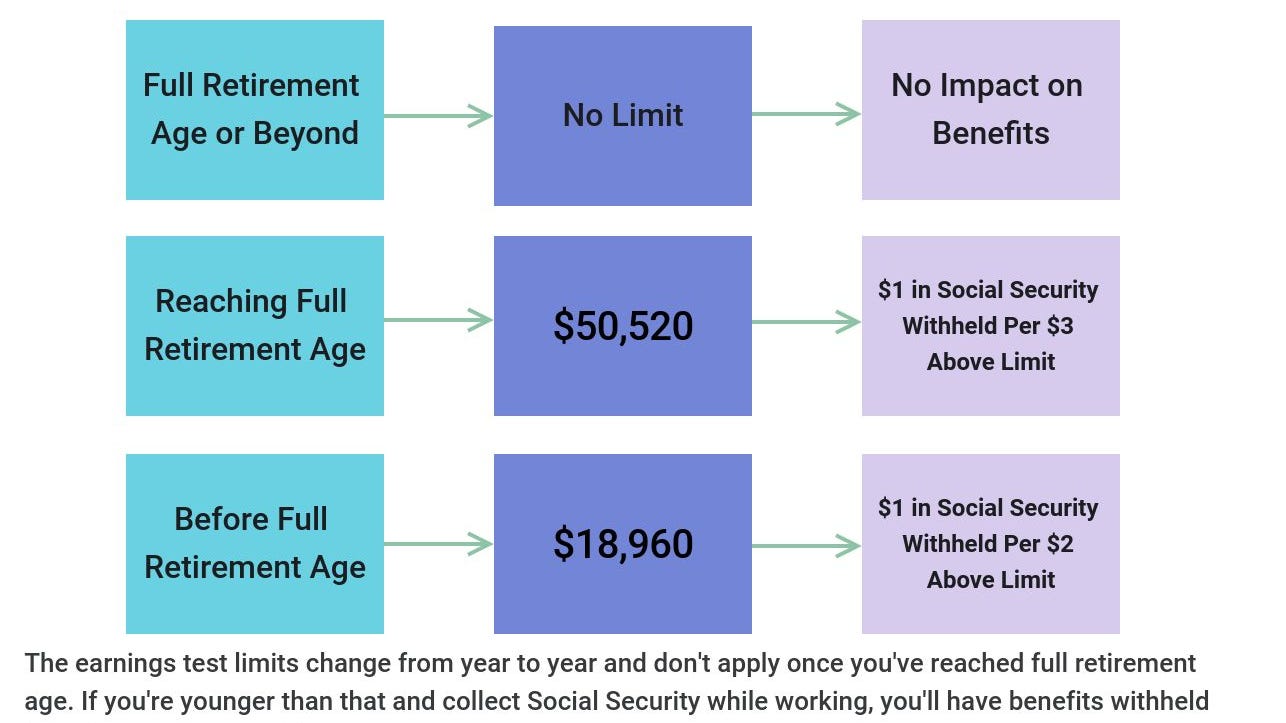

Once you earn more than the limit Social Security deducts. Full retirement age is based on your year of birth.

Can I Work And Collect Social Security

Can I Work And Collect Social Security

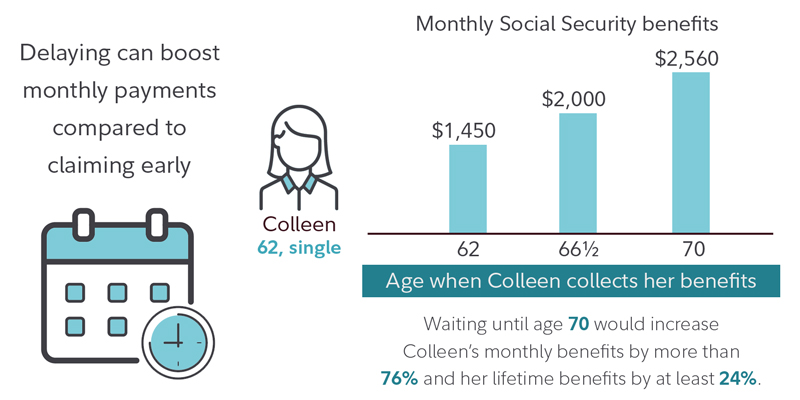

What and when you collect will make a huge difference to your lifetime benefits.

How much can you earn while collecting social security. Furthermore if youll be reaching FRA in 2021. According to Social Security the earnings limit if you retire mid year the year before your full retirement year you can only make 1420 per month not the total of 1420 times the number of months remaining int the year you retired. The earnings limits are adjusted annually for national wage trends.

The 2020 cap of 2110 for individuals receiving benefits because they are. After that youll lose 1 of annual. In 2021 you lose 1 in benefits for every 2 earned over 18960.

In 2019 the annual earnings limit for those achieving full retirement age in 2020 or later was 17640. For every 2 earned after that the benefit reduces by 1. In 2021 that limit is increasing to 18960.

Currently if youre a single filer and make 25000 to 34000 up to 50 percent of your benefits may be taxed. As of 2015 for any year prior to full retirement age the earnings limit is 15720 according to the SSA. Once you reach FRA there is no cap on how much you can earn and still receive your full Social Security benefit.

Todays post addresses the Social Security earnings test and. Are under full retirement age all year. If you start benefits prior to full retirement age you can only earn up to 18960 the limit for 2021 and still get your full benefits.

How Much Can I Earn. 9600 for the year You work and earn 28960 10000 over the 18960 limit during the year. Increased income may make your Social Security benefits taxable The percentage of your Social Security benefits subject to income tax will depend on your annual income.

If you work and earn 6000 throughout the year you have not hit the 17640 annual earnings that would trigger withholding of some of your Social. Most experienced Regenerative Medicine clinic in the area. Ad If joint neck or back pain is taking over your life you can gain your life back.

Ad If joint neck or back pain is taking over your life you can gain your life back. However once a person has already qualified as disabled there is a different lower earnings threshold that becomes relevant. The monthly income limits change each year.

You are entitled to 800 a month in benefits. For 2021 you will be deemed to be engaging in SGA when your monthly earned income exceeds 1310 which is an increase from the 2020 cap of 1260. Once your income exceeds that point youll have 1 in Social Security withheld for every 2 you earn.

Most experienced Regenerative Medicine clinic in the area. In the year the person turns full retirement age the earnings limit becomes 41880 and for every 3 earned thereafter benefits reduce by 1 until full retirement age is reached. For 2020 those who are younger than full retirement age throughout the year can earn up to 18240 per year without losing any of their benefits.

For income over 34000 up to 85 percent of benefits may be taxed. For 2020 the threshold for substantial gainful activity is 1260month or 2110month for a person who is blind. In 2021 the limit is 18950 for those reaching their full retirement age in 2022 or later.

If you opt to work while receiving Social Security before your full retirement age you will only be able to receive a certain level of income before your Social Security benefit is temporarily. You are receiving Social Security retirement benefits every month in 2021 and you. In 2020 the annual Social Security earnings limit for those reaching full retirement age FRA in 2021 or later is 18240.

Social Security may be one of your largest assets. The Social Security earnings limits are established each year by the SSA.

Collecting Social Security While Still Working Can You Claim Keep Earning Wages Youtube

Collecting Social Security While Still Working Can You Claim Keep Earning Wages Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

Your 2020 Guide To Working While On Social Security The Motley Fool

Your 2020 Guide To Working While On Social Security The Motley Fool

/how-does-the-social-security-earnings-limit-work-2388828-67b02d88fe9d4a5ba61fd301136a7424.png) Learn About Social Security Income Limits

Learn About Social Security Income Limits

Full Retirement Age For Getting Social Security The Motley Fool

Full Retirement Age For Getting Social Security The Motley Fool

When Should You Take Social Security Charles Schwab

When Should You Take Social Security Charles Schwab

What Happens If You Work While Receiving Social Security Social Security Us News

What Happens If You Work While Receiving Social Security Social Security Us News

/dotdash_Final_How_Much_Social_Security_Will_You_Get_Sep_2020-01-7ad4239b1c004d648a3c410fa10e03ec.jpg) How Much Social Security Will You Get

How Much Social Security Will You Get

What You Need To Know About Working While Collecting Social Security Social Security Personal Finance Lessons Social Security Benefits

What You Need To Know About Working While Collecting Social Security Social Security Personal Finance Lessons Social Security Benefits

/social-security-retirement-benefits-while-working-2894597-v1-1cd7c45096a24f059e87116a5c8e6326.png) Social Security Retirement Benefits While Working

Social Security Retirement Benefits While Working

Social Security At 62 Fidelity

Social Security At 62 Fidelity

What Are The 2021 Social Security Earnings Test Limits

What Are The 2021 Social Security Earnings Test Limits

Comments

Post a Comment