Chase Credit Card Requirements

- Get link

- X

- Other Apps

Only one payment per billing cycle qualifies. So if your income isnt high enough and Chase isnt comfortable giving you that much credit then you wont be approved for the card.

What Is Chase S 5 24 Rule What It Means For Your Credit Card Applications

Choose from our chase credit cards to.

Chase credit card requirements. But you usually get between 103 and 115 days. Many offer rewards that can be redeemed for cash back or for rewards at companies like Disney Marriott Hyatt United or Southwest Airlines. Thats 1000 when you redeem through Chase Ultimate Rewards.

We can help you find the credit card that matches your lifestyle. I recommend contacting Chase once you get a new card to confirm the exact date. 551 Credit Score Needed The Chase Slate credit card is a minimalist card with no rewards and relatively few perks.

Many offer rewards that can be redeemed for cash back or for rewards at companies like Disney Marriott Hyatt United or Southwest Airlines. Chase student credit card requirements. Chase says you have 3 months from the card approval date to meet minimum spending requirements.

So I always recommend spending slightly more than the minimum requirement in case you have to make a return. Most Chase cards require a score of at least 600 which is about the dividing line between fair and poor credit. If youve opened five or more credit cards from any bank in the past 24 months you wont be eligible for a Chase credit card.

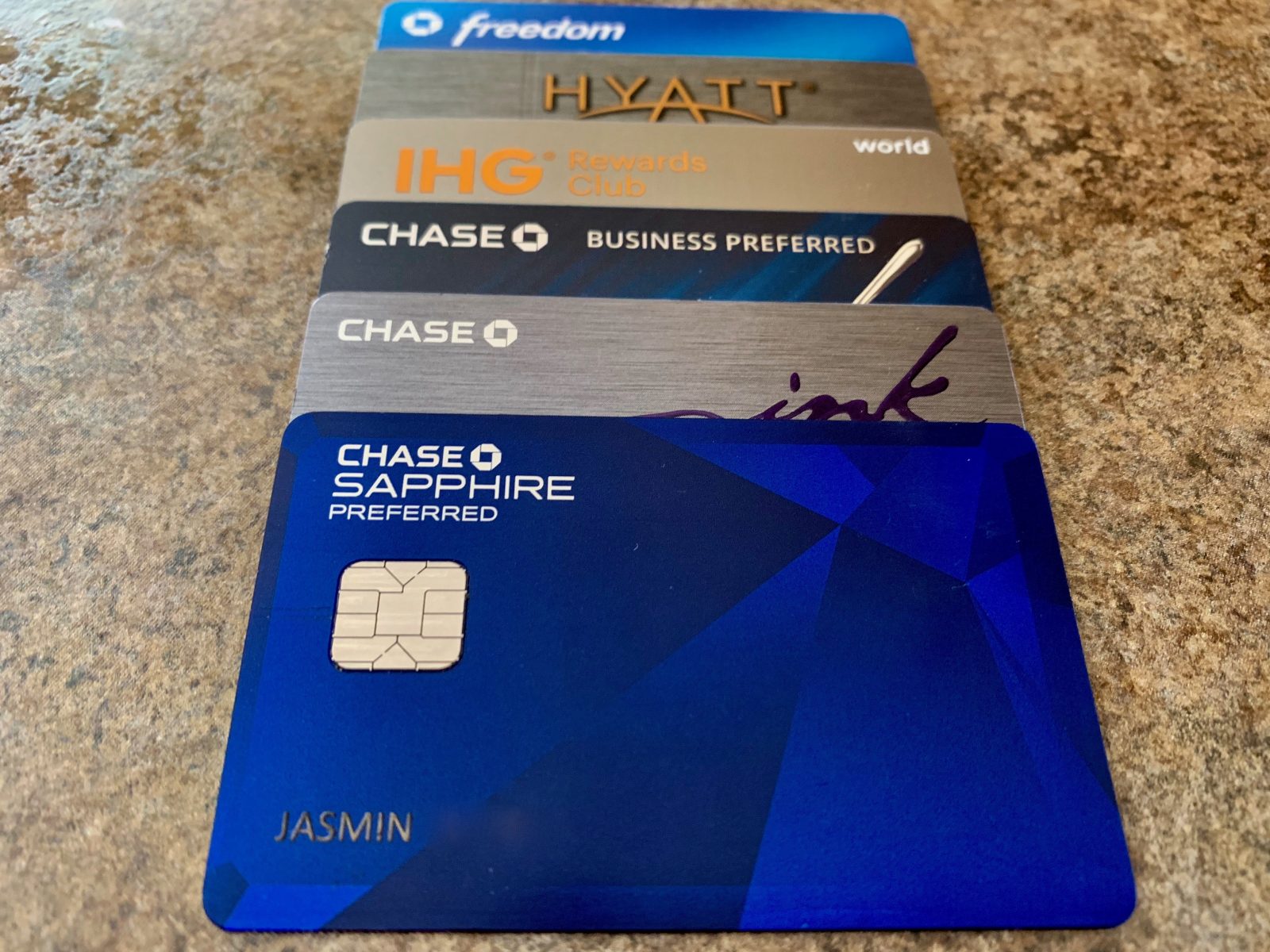

I currently have seven Chase-issued cards. 5 cash back on travel purchased in the Ultimate Rewards portal 3 cash back on drugstore and restaurant purchases 1 cash back on all. Chase Sapphire Preferred Card.

Heres how it works. Choosing the best American Express credit card for you. Fortunately the approval requirement for Chase Freedom cards is not as strict as for the Chase Sapphire credit score requirements.

4 good or excellent credit. Reports suggest that youll typically need a score of at. The Chase Sapphire Reserve has slightly stricter approval requirements than its little brother the Chase Sapphire Preferred Card.

As a Chase Private Client you may be able to open additional Chase credit cards including their business cards even if you are over the 524 limit. 5 fewer than five credit cards opened in the last two years widely rumored but not confirmed. 5 cash back on up to 1500 in combined purchases in bonus categories you activate each quarter.

Was approved for 5K. This card is generally for those with Good to Excellent credit. Plus get your free credit score.

There are multiple credit scores from different credit bureaus. Choose from our Chase credit cards to help you buy what you need. Chase usually looks for a great credit score or a banking relationship.

Plus get your free credit score. Moreover some of Chases card have minimum credit limits. I tried applying for their Sapphire regular one and was denied due to low income reported 25K.

There are a handful of universal minimum Chase credit card requirements. Ink Business Cash Credit Card. In return it offers easy approval accepting credit scores in the 551 to 600 range for 8 of its cardholders according to a credit karma survey of cardholders.

3 enough money for monthly bill payments. But Chase also has one of the more restrictive application rules for its cards the dreaded 524 rule. Its a lot easier and less risky for Chase to give you a credit line of 1000 with the Chase Freedom as opposed to the minimum 10000 credit limit with the Chase Sapphire Reserve.

Thats harsh but there are ways to work around it. Rushed replacement of your debit or credit card almost anywhere worldwide at no charge. From my personal experience and research online it appears that Chase doesnt formally limit the number of credit cards you have.

Most Chase credit cards are intended for consumers with good to excellent credit scores. Higher welcome bonuses available for in-branch credit card sign-ups on a case by case basis Hot Tip. Plus earn up to 50 in statement credits towards grocery store purchases within your first year of account opening.

That means you should have a FICO Score of 670 or higher when you apply. And 6 no bankruptcy on your credit report widely rumored but not confirmed. Everyday cash back.

Chase Number of Cards. Choose from our Chase credit cards to help you buy what you need. Chase Freedom Unlimited Travel.

But in general 680 is considered a good score. We can help you find the credit card that matches your lifestyle. Like for the Chase Sapphire Preferred the credit limit is 5000 and 1000 for the Sapphire Reserve.

Does anyone know if there are minimum income requirements for Chase specifically for their Freedom Sapphire cards. Chase Sapphire Preferred Card Earn 80000 bonus points after you spend 4000 on purchases in the first 3 months from account opening.

Chase Sapphire Preferred Credit Card Chase Com

Chase Sapphire Preferred Credit Card Chase Com

Churners Think Twice Before Applying For A Chase Credit Card Doctor Of Credit

Churners Think Twice Before Applying For A Chase Credit Card Doctor Of Credit

Freedom Student Credit Card Chase Com

Freedom Student Credit Card Chase Com

2021 Credit Scores Needed For Chase Cards

2021 Credit Scores Needed For Chase Cards

Chase Freedom Unlimited Credit Card Chase Com

Chase Freedom Unlimited Credit Card Chase Com

Chase Credit Card Requirements How To Get Approved

Chase Credit Card Requirements How To Get Approved

![]() Chase Freedom Credit Card 2021 Review Should You Apply

Chase Freedom Credit Card 2021 Review Should You Apply

Chase Sapphire Reserve Credit Card Chase Com

Chase Sapphire Reserve Credit Card Chase Com

Chase Sapphire Preferred Credit Card Review Cnn Underscored

Chase Sapphire Preferred Credit Card Review Cnn Underscored

My Chase Credit Card Strategy 2021 One Mile At A Time

My Chase Credit Card Strategy 2021 One Mile At A Time

Chase Freedom Flex Credit Card Chase Com

Chase Freedom Flex Credit Card Chase Com

Under 5 24 Time For A New Chase Credit Card Strategy Million Mile Secrets

Under 5 24 Time For A New Chase Credit Card Strategy Million Mile Secrets

How To Turn Cash Back Into Ultimate Rewards Points With Chase Cards

Chase Sapphire Preferred Card Does It Live Up To The Hype Credit Card Review Valuepenguin

- Get link

- X

- Other Apps

Comments

Post a Comment