Reit Dividend Yield

- Get link

- X

- Other Apps

REITs operate in the industrial mortgage residential and healthcare sub industries where they pool capital from several investors and pay out dividends from the funds underlying real estate holdings. As a result it is worth our while as investors to understand what Reits are and how to assess them.

Reit Sectors From The Lens Of A Dividend Investor Seeking Alpha

Reit Sectors From The Lens Of A Dividend Investor Seeking Alpha

Distribution Yield Price to Book DPU NAV Property Yield Gearing Ratio.

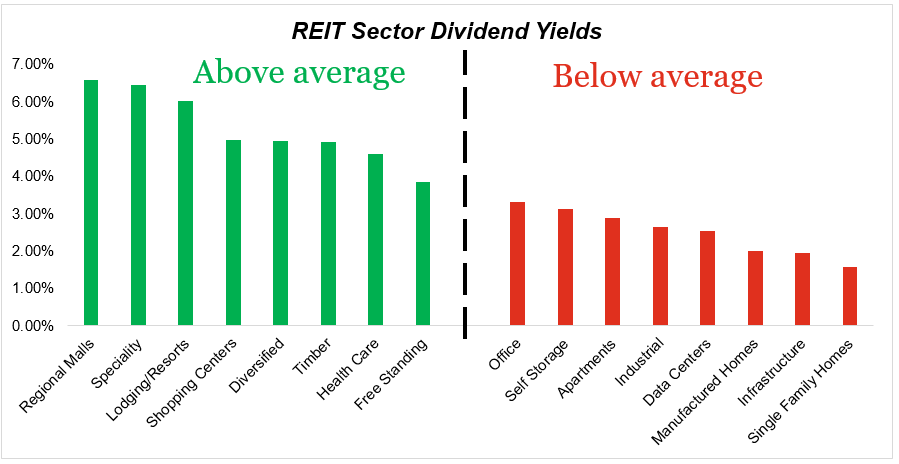

Reit dividend yield. But even with this appreciation the REIT still pays a nice dividend. AIRCs most recent quarterly dividend payment was made to shareholders of record on Friday February 26. REIT dividenddistribution yields The average yield for all REITs is 62.

K71U Keppel REIT holds a portfolio of Grade A commercial assets in key business districts within Asia. According to the chart below where dividend yield is displayed Keppel REIT has a dividend yield of 500 which is higher than the amount offered by both the market average and companies from Singapore. A real estate investment trust REIT is a company that owns operates or finances income-generating real estate across a range of industries.

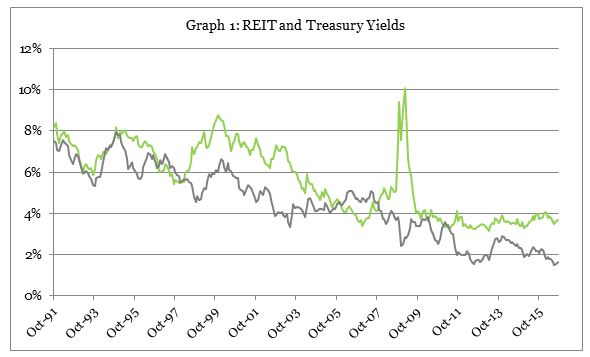

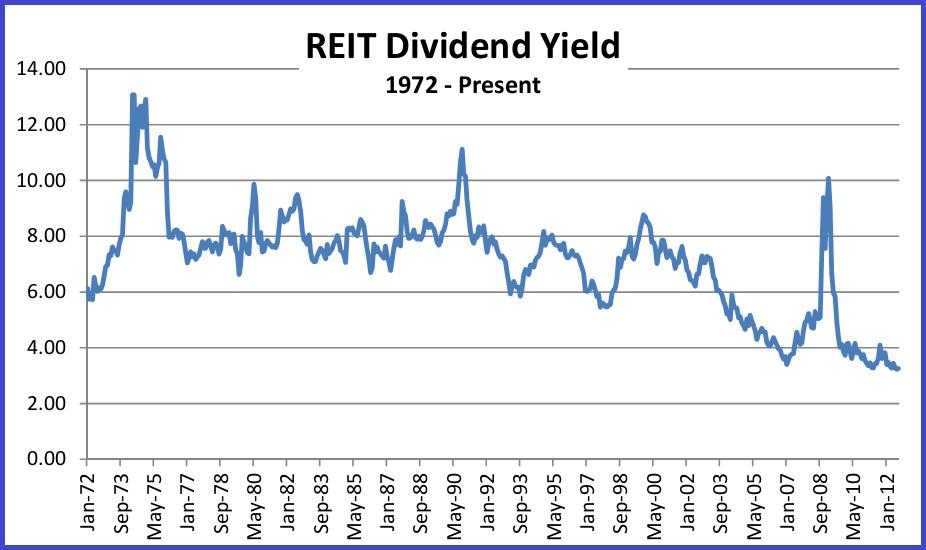

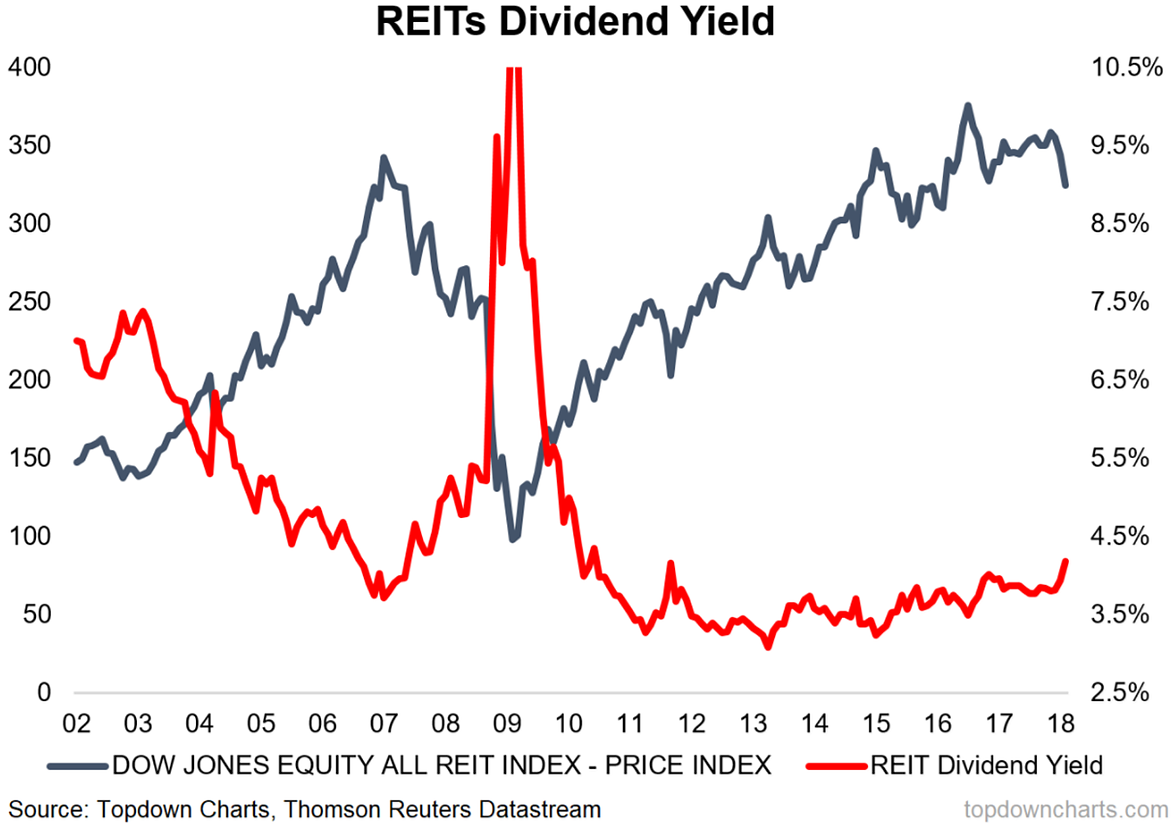

Public listed REITs paid out approximately 532 billion and public non-listed REITs paid out approximately 43 billion in dividends during 2017. With the reduced interest rates in both Malaysia and Singapore REITs definitely appear to be an amazing investment alternativeIf you are new to REITs you can read more about what REITs are here. But be wary when comparing historical average dividend yield to value a REIT.

For context consider that the average dividend yield paid by stocks in the SP 500 is 19. The REIT has assets under management of over S8 billion in Singapore Australia and South Korea. One may think that this could be a good deal.

ARA US Hospitality Trust. Most Reits offer a dividend yield of 4-5 which is way higher than the current savings rate or the yield on the Singapore Savings Bond. While the SP 500 Index on average yields less than 2 right now it is relatively easy to find REITs with dividend yields of 5.

The annual payment of 48 cents works out to be a yield of 938. Consider the biggest mall landlord of them all Simon Property Group SPG SPG -05 which boasts a forward yield of 61 but thats not. Apartment Income REIT pays an annual dividend of 172 per share with a dividend yield of 379.

For example Lippo Mall is currently trading at a 95 annualised yield which is higher than its historical average of 86. Retail REITs in particular are classic yield traps. Dividend Payments by Month or Quarter Q1 2020.

The REIT with the highest yield is Eagle Hospitality Trust at 94. It is also bigger than average of Financials industry. REITs widely offer higher dividend yields than the average stock.

One of the reasons people are attracted to REITs is from the high dividend yield. The trailing dividend yield for the REIT stands at 76 at a share price of S069. The REIT with the lowest yield is ParkwayLife REIT at 38.

In contrast the average equity REIT which owns. On average 59 percent of the annual dividends paid by REITs qualify as ordinary taxable income 17 percent qualify. Though dividend yield from REITs is a factor to be considered when screening for a viable REITs.

Reit Dividend Yields New Low Rates Are Normal But Not A New Normal Seeking Alpha

Reit Dividend Yields New Low Rates Are Normal But Not A New Normal Seeking Alpha

Chart Of The Week U S Reit Dividend Yields Seeking Alpha

Chart Of The Week U S Reit Dividend Yields Seeking Alpha

Reit Dividend Yields Forward Returns 1972 2015 Bogleheads Org

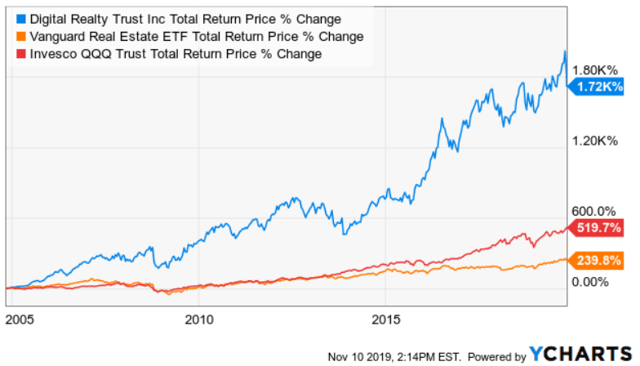

Reit How Does A Reit Grow Why A Low Dividend Yield Reit Grows Better And More Attractive Than High Dividend Yield Reit Investment Moats

Fat Dividend Yields Or Big Growth From Reits In 2020 Seeking Alpha

Fat Dividend Yields Or Big Growth From Reits In 2020 Seeking Alpha

Reits Part I Decomposing Dividend Yields Reality Inversion

Reits Part I Decomposing Dividend Yields Reality Inversion

Historical Reit Spreads Dividend Yields Vs U S Treasuries Millionacres

Historical Reit Spreads Dividend Yields Vs U S Treasuries Millionacres

Comments

Post a Comment