High Apr Credit Card

- Get link

- X

- Other Apps

What does APR mean. 0 for 15 months.

What Is The Average Credit Card Interest Rate

What Is The Average Credit Card Interest Rate

A high APR means that you will be paying a higher interest rate on any money you borrow and do not repay on your credit card.

High apr credit card. Many credit cards also have higher APRs that apply to cash advances or a penalty APR thats imposed when the account holder misses payments. Since the first week of January the annual percentage rate or APR for variable-rate credit cards the most commonly available has increased to 1531 percent from 1456 percent. When you apply for a new credit card itll usually list an APR range but the exact percentage will depend on.

Our Experts Found the Best Credit Card Offers for You. Our Experts Found the Best Credit Card Offers for You. Where credit cards use a representative APR this means 51 of successful applicants must be given the stated rateWith credit cards the rate for purchases as opposed to balance transfers or cash withdrawals is used as the main rate to advertise the card.

The average credit card APR isnt necessarily reflective of the APR youll receive on a credit card youre approved for though. Capital One Platinum Credit Card. Average APR is currently almost 235 You can find the interest rates for your accounts listed on your monthly credit card statement.

Earn unlimited 15 points per 1 spent on all purchases and your points never expire. The Federal Reserve determines. Visa Signature credit cards the middle tier are easier to.

Bank of America Cash Rewards Credit Card for Students. As long as you pay your credit card balance in full each month APR may matter less than you might think. When the prime rate.

Credit cards often have several different APRs. 25000 online bonus points after you make at least 1000 in. A good credit card APR can vary widely based on.

Store credit cards also come with high APRs which is one reason we dont recommend them. For example a credit card might set its APR to the prime rate plus 35. Visa offers these tiers.

High penalty APR and late fee. 1399 - 2399 V regular APR. Traditional Visa Signature and Visa Infinite.

A variable APR can change over time and is usually based on a benchmark rate. Reward credit cards tend to have higher APR averaging above 1625 If you have bad credit then it means higher APR too. Ad Zero Interest Credit Cards.

Capital One QuicksilverOne Cash Rewards. The APR quoted on a card means the interest rate. According to the Federal Reserves data for the third quarter of 2020 the average APR across all credit card accounts was 1458.

Capital One Secured Mastercard. They are usually listed in a table somewhere on the first page of your statement. For example many credit cards have a 0 introductory APR or another lower-than-standard rate that applies for a limited time after the account is opened.

Ad Zero Interest Credit Cards. Ad Get a Card with 0 APR Until 2022. The top tier Visa Infinite targets high-net-worth individuals.

Credit cards may offer a 0 intro APR on purchases a 0 intro APR on balance transfers or a 0 intro APR on both types of transactions. Ad Get a Card with 0 APR Until 2022.

Apr Credit Cards Ok What S Catch Text Word Vector Image

Apr Credit Cards Ok What S Catch Text Word Vector Image

/what-does-apr-mean-315004-v3-jl-442b370734d44759ac43d09edcc3fb26.png) What Apr Tells You About A Loan

What Apr Tells You About A Loan

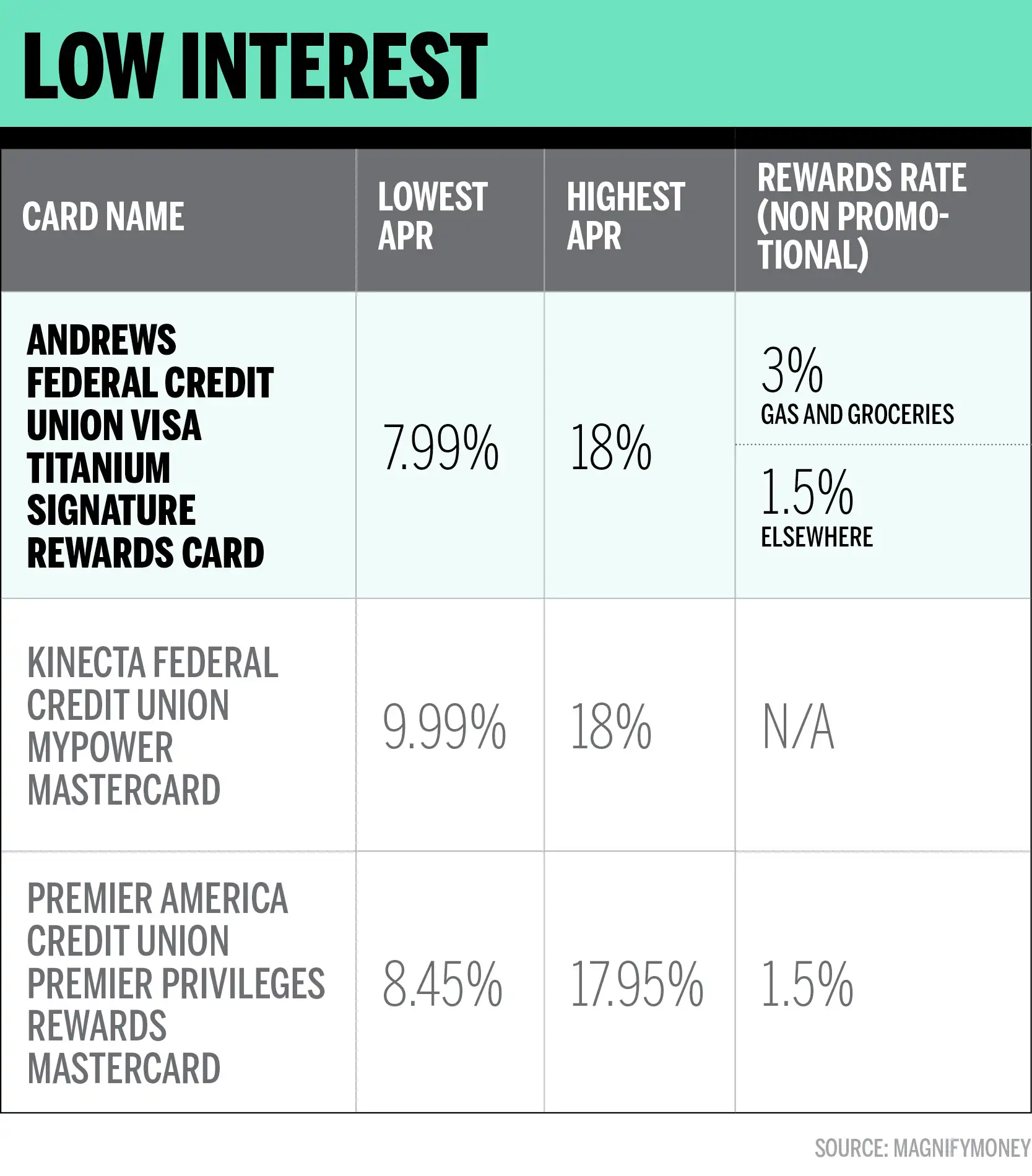

This Is The Best Low Interest Rate Credit Card For 2019 Money

This Is The Best Low Interest Rate Credit Card For 2019 Money

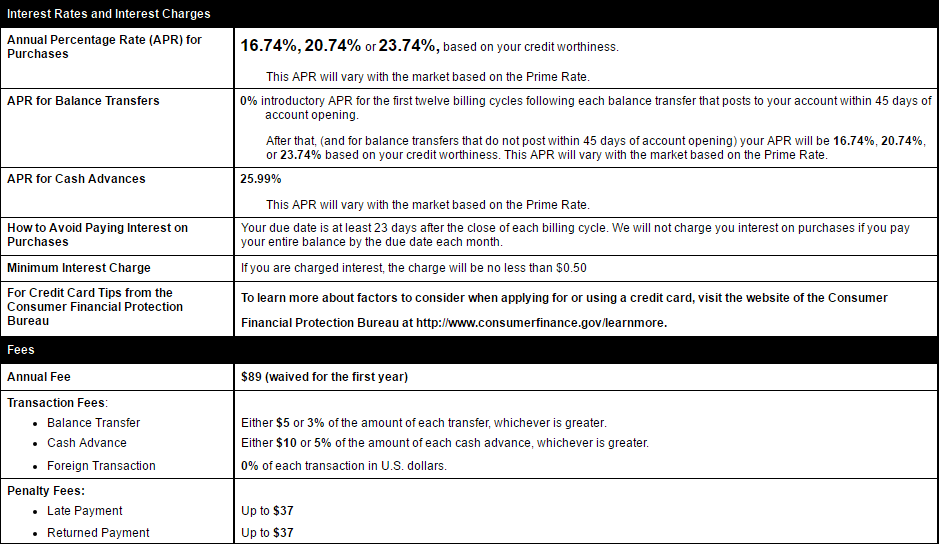

Understanding Credit Card Aprs Interest Rates Valuepenguin

/stack-of-multicolored-credit-cards-close-up-view-with-selective-focus--682285434-5a8f61b7119fa80037df8d7c.jpg) Average Credit Card Interest Rate Is 20 29

Average Credit Card Interest Rate Is 20 29

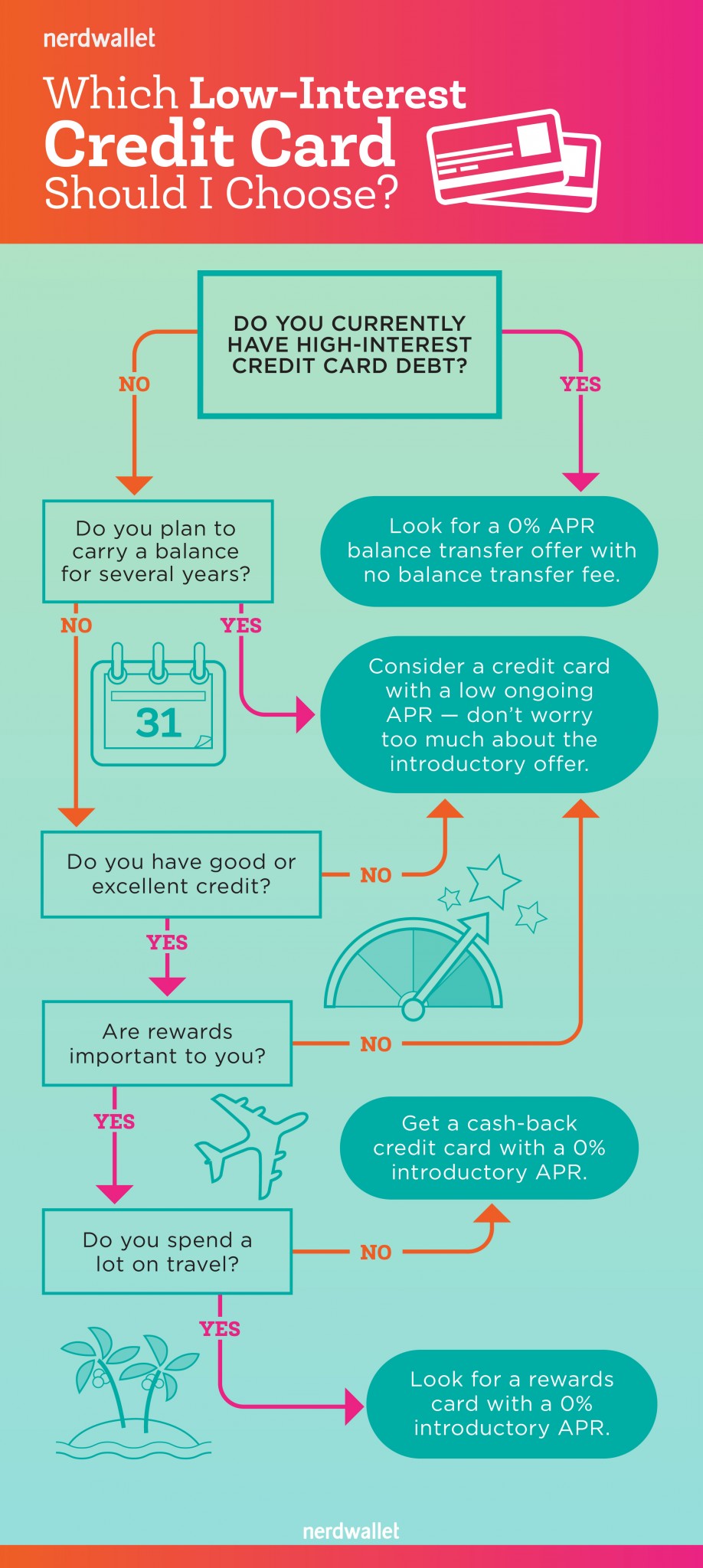

Flowchart Find The Right Low Interest Credit Card Nerdwallet

Flowchart Find The Right Low Interest Credit Card Nerdwallet

What Is A Good Apr For A Credit Card Rates By Score

What Is A Good Apr For A Credit Card Rates By Score

What Is High Apr On A Credit Card Consolidated Credit

What Is High Apr On A Credit Card Consolidated Credit

What Is A Good Apr For A Credit Card Experian

What Is A Good Apr For A Credit Card Experian

What Is High Apr On A Credit Card Consolidated Credit

What Is High Apr On A Credit Card Consolidated Credit

Top Balance Transfer Cards Top Balance Transfer Credit Cards Credit Card Transfer Balance Transfer Credit Cards

Top Balance Transfer Cards Top Balance Transfer Credit Cards Credit Card Transfer Balance Transfer Credit Cards

What Is Apr Understanding How Apr Is Calculated Apr Types

Comments

Post a Comment