What Makes Your Credit Score Go Down

- Get link

- X

- Other Apps

Your credit score is a rating that reflects how well youve managed your finances in the past and having a good score can give you more options when youre looking for a credit card loan or mortgage. Most importantly each time that you check your file the bureau logs a soft inquiry.

What Things Can Make Your Credit Score Go Down Dot Com Women

What Things Can Make Your Credit Score Go Down Dot Com Women

What Makes Your Credit Score Go Up and Down.

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png)

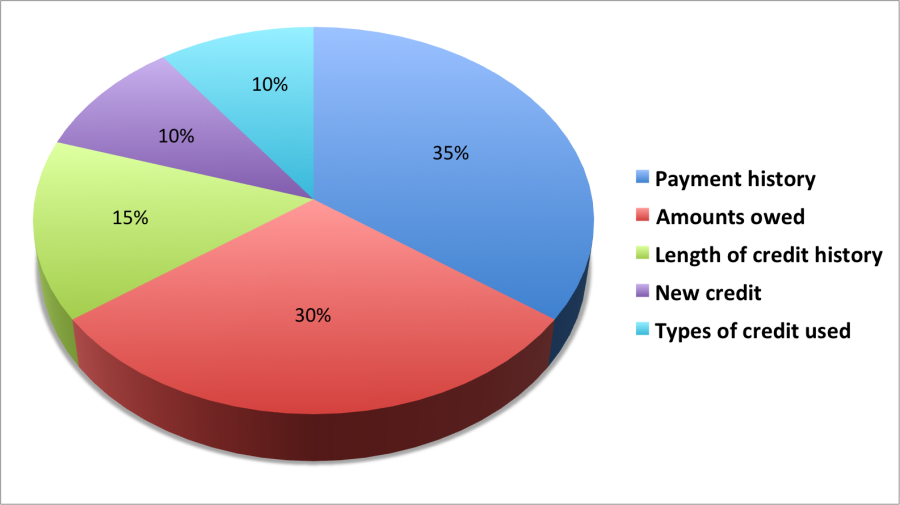

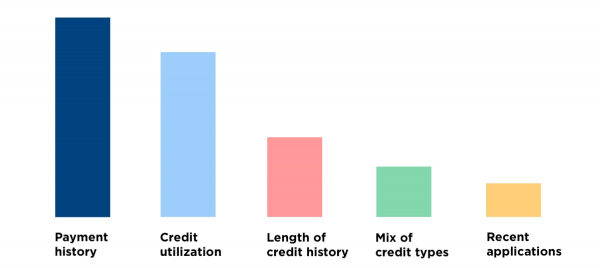

What makes your credit score go down. Length Of Your Credit History 15. Pay down your credit accounts to increase your score. Late credit card payments may lower a persons credit score.

Adverse reports on your credit report will likely cause your credit score to go down. If you allow someone else to pull your. While it might seem that checking your credit score lowers it coincidence is a more likely culprit.

What can make your credit score go up or down. What to Do Now So what do you do. How Much You Owe 30.

You may not have control over whether your credit card issuer reduces your credit limit but if this happens paying down your balance can improve your credit utilization and your credit score. Your Payment History 35. Checking your own scores will create a soft inquiry onto your credit reports which do not lower your scores.

You closed a credit card or loan. Late payments lower your score so pay your bills on time. Ratings fluctuate every day as lenders send updated data to the bureaus so you have a 50 chance of seeing a drop each time you look at a new version of your report.

Keep your outstanding balances under 30 of your credit limits. Credit scores can fall temporarily at least when you take on new credit and taking out more than one new loan would impact a score. When your credit score has taken a dive its time to take a closer look and possibly take action.

If you have a balance on a credit card with a low credit limit your credit utilization goes up and your credit score goes down. Your credit score will likely lose a few points if you close a credit card or loan because youre cutting down your available credit which negatively impacts your credit utilization ratio. Ad Search for Expert Information.

Ad Search for Expert Information. Your credit report is what dictates your credit score so if you find an error take the necessary steps to correct the mistake on your credit report. You need to make a.

Multiple credit cards with high balances can make your credit score go down. And dont forget that credit report inaccuracies due to mistakes or identity theft can also cause a dip. When Checking Credit does not Hurt Scores.

Paying bills on time is critical to improving credit scores. A drop of 15-20 points or more could be due to higher balances reported on one or more of your credit cards or it could indicate fraud or something negative impacting your credit scores adds Detweiler. Credit scores can drop due to a variety of reasons including late or missed payments changes to your credit utilization rate a change in your credit mix closing older accounts which may shorten your length of credit history overall or applying for new credit accounts.

What Makes Your Credit Score Go Up And Down The Madrona Group

What Makes Your Credit Score Go Up And Down The Madrona Group

True Or False My Credit Score Will Drop After Bankruptcy Fiallo Law

True Or False My Credit Score Will Drop After Bankruptcy Fiallo Law

How To Raise Your Credit Score Fast The Broke Professional

Living Stingy How To Game Your Credit Score And Why You Shouldn T

Living Stingy How To Game Your Credit Score And Why You Shouldn T

Why Did My Credit Score Go Down Minilua

Why Did My Credit Score Go Down Minilua

Why Did My Credit Score Drop 7 Common Reasons

Why Did My Credit Score Drop 7 Common Reasons

How To Improve Your Credit Score Advance America

How To Improve Your Credit Score Advance America

How To Improve Your Credit Score Fast Experian

How To Improve Your Credit Score Fast Experian

Why Did My Credit Score Drop Mintlife Blog

Why Did My Credit Score Drop Mintlife Blog

How To Improve Your Credit Score Tips For Fico Repair

How To Improve Your Credit Score Tips For Fico Repair

What Factors Affect Your Credit Scores Nerdwallet

What Factors Affect Your Credit Scores Nerdwallet

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

How To Improve Your Credit Score By 100 Points In 30 Days

How To Improve Your Credit Score By 100 Points In 30 Days

What Makes Your Credit Score Go Up And Down The Madrona Group

What Makes Your Credit Score Go Up And Down The Madrona Group

Comments

Post a Comment