Nerdwallet Income Tax Calculator

- Get link

- X

- Other Apps

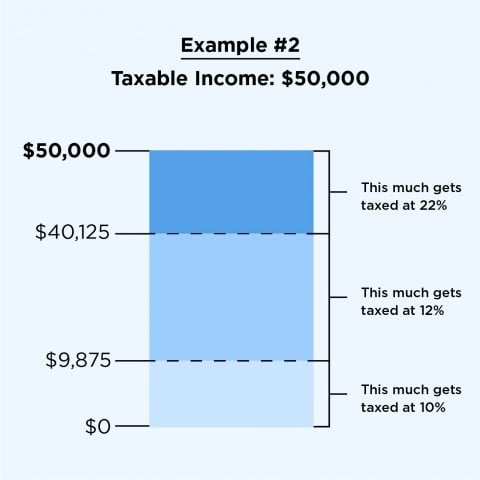

Your household income location filing status and number of personal exemptions. If you had 50000 of taxable income youd pay 10 on that first 9875 and 12 on the chunk of income between 9876 and 40125.

Free Income Tax Calculator Estimate Your Refund Nerdwallet

Free Income Tax Calculator Estimate Your Refund Nerdwallet

Quickly estimate your 2020 tax refund amount with TaxCaster the convenient tax return calculator thats always up-to-date on the latest tax laws.

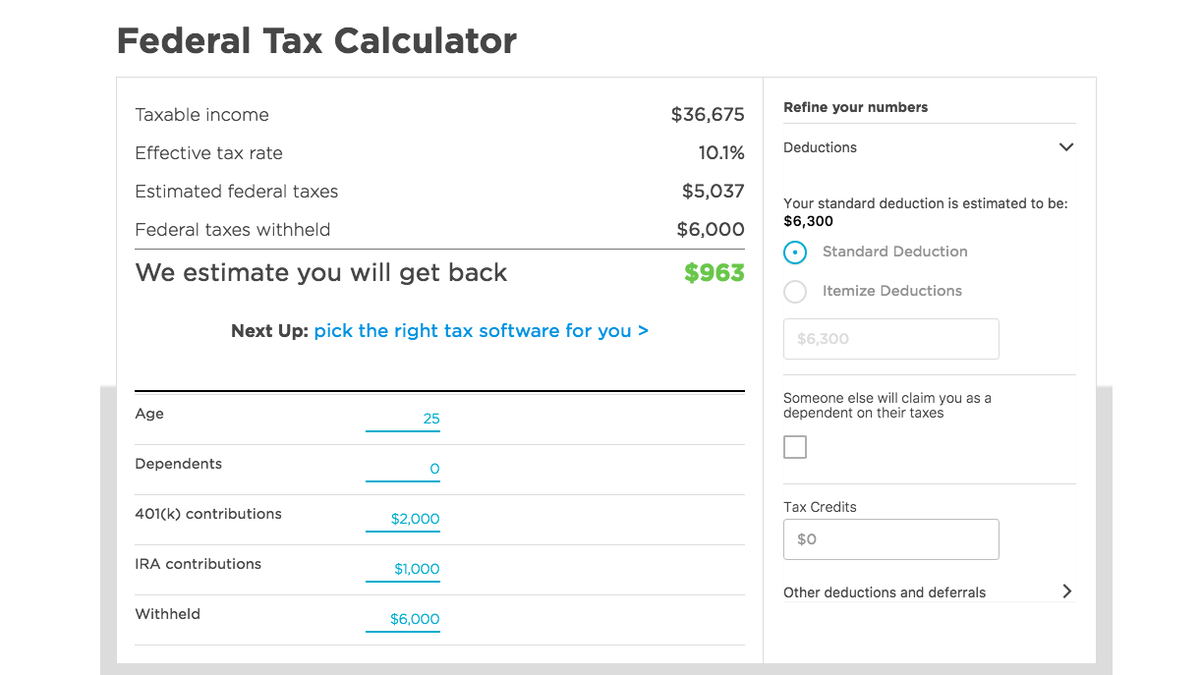

Nerdwallet income tax calculator. You enter your income how much you can deduct if youve made contributions to a 401k or traditional IRA then add your withholding and the tool uses your effective tax rate to calculate your Federal. INCOME TAX CALCULATOR Estimate your 2020 tax refund. Capital gains calculator Federal income tax calculator.

Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021. Salary Lien Provision for Unpaid Income Taxes. It can also be used to estimate income tax for the coming year for 1040-ES filing planning ahead or comparison.

NerdWallet strives to keep its information accurate. It can be used for the 201314 to 201920 income years. Answer a few simple questions about your life income and expenses and our free tax refund calculator will give you an idea if you should expect a refund and how muchor if the opposite is true and youll owe the IRS when you file in.

Tax Calculators for the Individual Taxpayers. The provided information does not constitute financial tax or legal advice. This amount minus your deductions is used to calculate your taxable income.

How to fill out or update your W4 Tax brackets and rates Track your federal and state refunds Federal income tax calculator All about taxes. You will enter wages withholdings unemployment income Social Security benefits interest dividends and more in the income section so we can determine your 2020 tax bracket and calculate your adjusted gross income AGI. Two big changes in 2020 were self employed people were able to claim unemployment benefits AND.

2020 Simple Federal Tax Calculator Important. The Maryland legislature in its 2002 session passed a bill that changed the amount to be exempted from the salary lien provision of the income tax law in order to conform with amounts for other wage liens listed in the Commercial Law Article Section 15-601-1. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

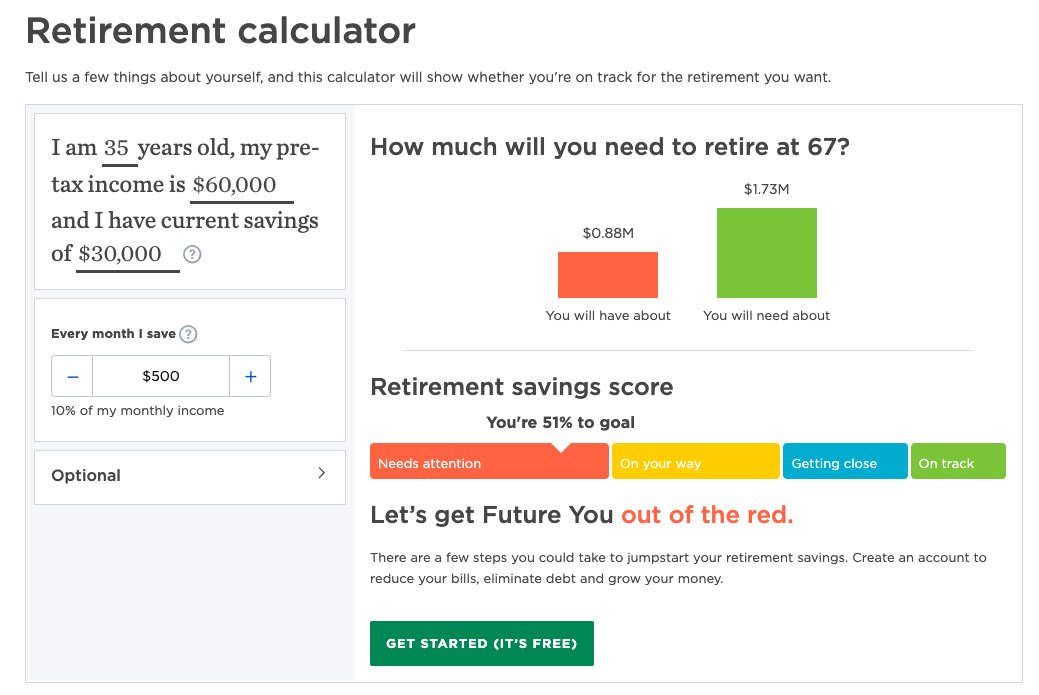

And then youd pay 22 on. If you save 15 of your income and elect to spend at NerdWallets assumed rate of 20 less than you do pre-retirement the. To give you an idea of how much youll owe or how big your refund will be plug your info into NerdWallets Federal Tax Calculator.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan.

Income Tax Calculator 2020 Estimate your tax refund. Although you will need to pay the tax when its due during the year it will be deductible on your 1040 at tax time also according to NerdWallet. Now theres also the qualified business income deduction which allows self-employed individuals and business owners to deduct a portion of their business income.

NerdWallet gives you a complete view of your money. How to fill out or update your W4 Tax brackets and rates Track your federal and state refunds Federal income tax calculator All about taxes. The changes to the tax withholding schedules announced in the Federal Budget 202021 are not reflected in this calculator as the 202021 calculator wont be available.

How to fill out or update your W4 Tax brackets and rates Track your federal and state refunds Federal income tax calculator All about taxes. This interactive free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file. For age 71 and up the limit is 5430.

Explore many more calculators on tax finance math fitness health and more. For tax year 2020 the maximum tax deduction for long-term care premiums for people ages 61 to 70 is 4350 per person. Simply fill in each of the fields with your best estimate for each type of monthly debt.

Most types of income are taxable. NerdWallet strives to keep its information accurate. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

We strive to make the calculator perfectly accurate. The NerdWallet Debt-to-Income Ratio Calculator crunches the numbers for you.

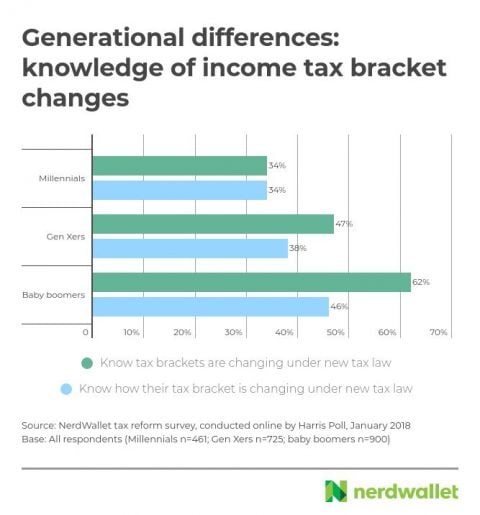

2018 Tax Study Most Americans In The Dark On Key Deductions And Rules Nerdwallet

2018 Tax Study Most Americans In The Dark On Key Deductions And Rules Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

2020 2021 Federal Income Tax Brackets Tax Rates Nerdwallet

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

The 20 Best Online Tools To Calculate Your Income Taxes In 2021

50 30 20 Budget Calculator Nerdwallet Astuces

50 30 20 Budget Calculator Nerdwallet Astuces

Bagaimana Billionaire Membayar 0 Dalam Pajak Penghasilan Federal

Bagaimana Billionaire Membayar 0 Dalam Pajak Penghasilan Federal

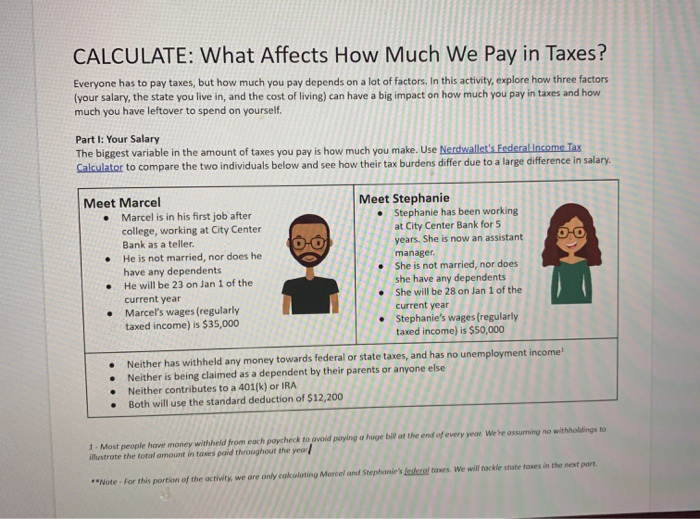

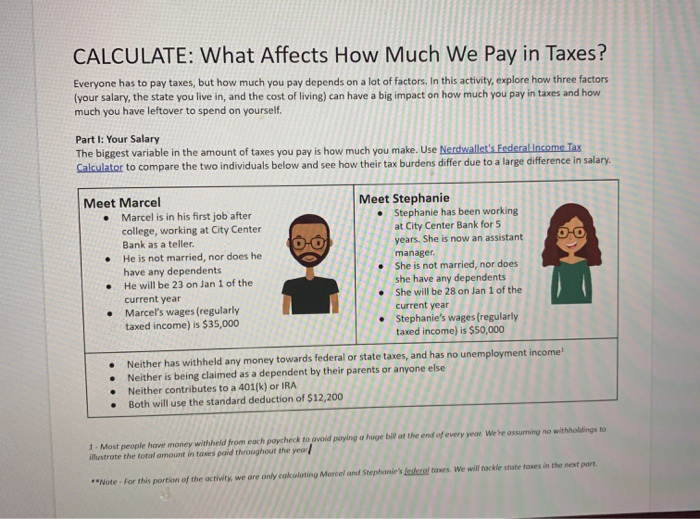

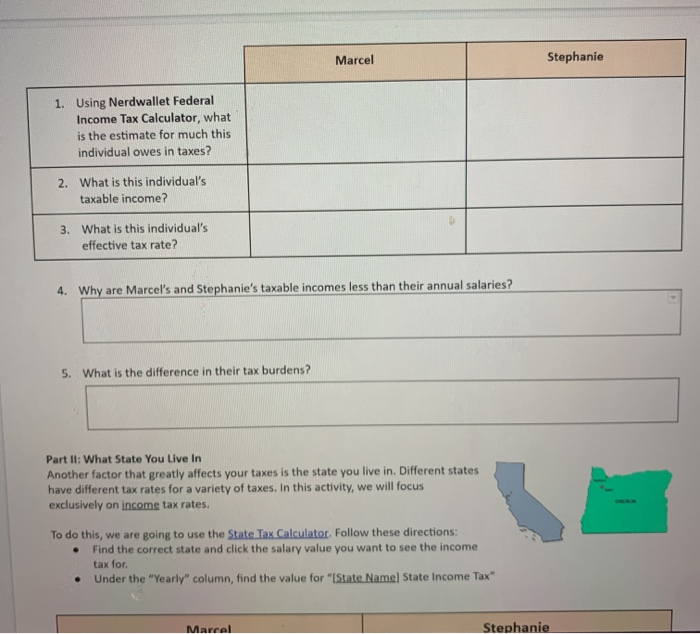

Calculate What Affects How Much We Pay In Taxes Chegg Com

Calculate What Affects How Much We Pay In Taxes Chegg Com

Ross Hudgens On Twitter 2 Nerdwallet S Calculators W Almost Perfect Ux Ux Perfection Is Arguably Possible With A Simple Calculator You Can T Get Much Better Than Https T Co 8nig1jjice Or Https T Co Ebevkedbz9 By Getting To

Ross Hudgens On Twitter 2 Nerdwallet S Calculators W Almost Perfect Ux Ux Perfection Is Arguably Possible With A Simple Calculator You Can T Get Much Better Than Https T Co 8nig1jjice Or Https T Co Ebevkedbz9 By Getting To

Nerdwallet S Federal Tax Calculator Estimates How Much You Ll Owe Or Get Back

Nerdwallet S Federal Tax Calculator Estimates How Much You Ll Owe Or Get Back

Nerdwallet 2020 Tax Report Nerdwallet

Nerdwallet 2020 Tax Report Nerdwallet

Calculate What Affects How Much We Pay In Taxes Chegg Com

Calculate What Affects How Much We Pay In Taxes Chegg Com

State Income Tax Rates What They Are How They Work Nerdwallet

State Income Tax Rates What They Are How They Work Nerdwallet

- Get link

- X

- Other Apps

Comments

Post a Comment