Credit Score Required For Credit Card

- Get link

- X

- Other Apps

Many credit cards require good to excellent credit to qualify. If you have a score at the lower end of the fair score range a premium credit card is all but out of the question.

![]() Credit Cards Low Credit Score Best Credit Cards For Credit Score Under 599 Bad Credit A Good Credit Score Supported By A Strong Credit History Is The Key To Getting

Credit Cards Low Credit Score Best Credit Cards For Credit Score Under 599 Bad Credit A Good Credit Score Supported By A Strong Credit History Is The Key To Getting

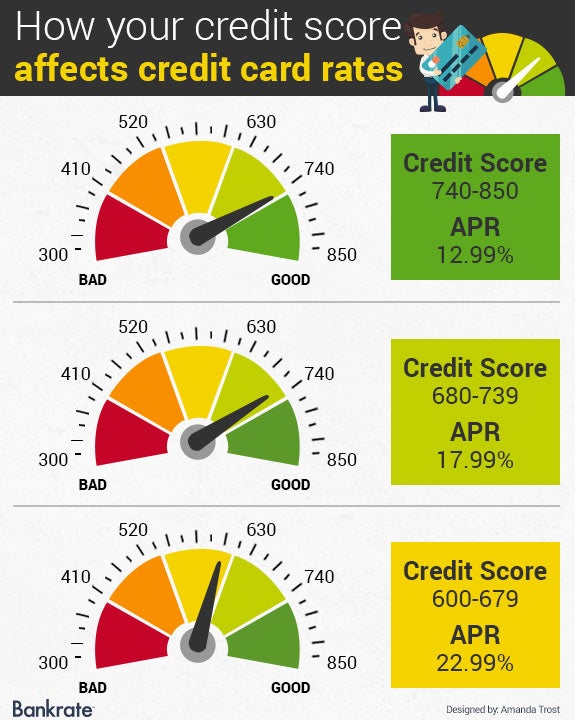

A score in the 580 to 669 range is a fair score while a score of 670 to 739 is considered good.

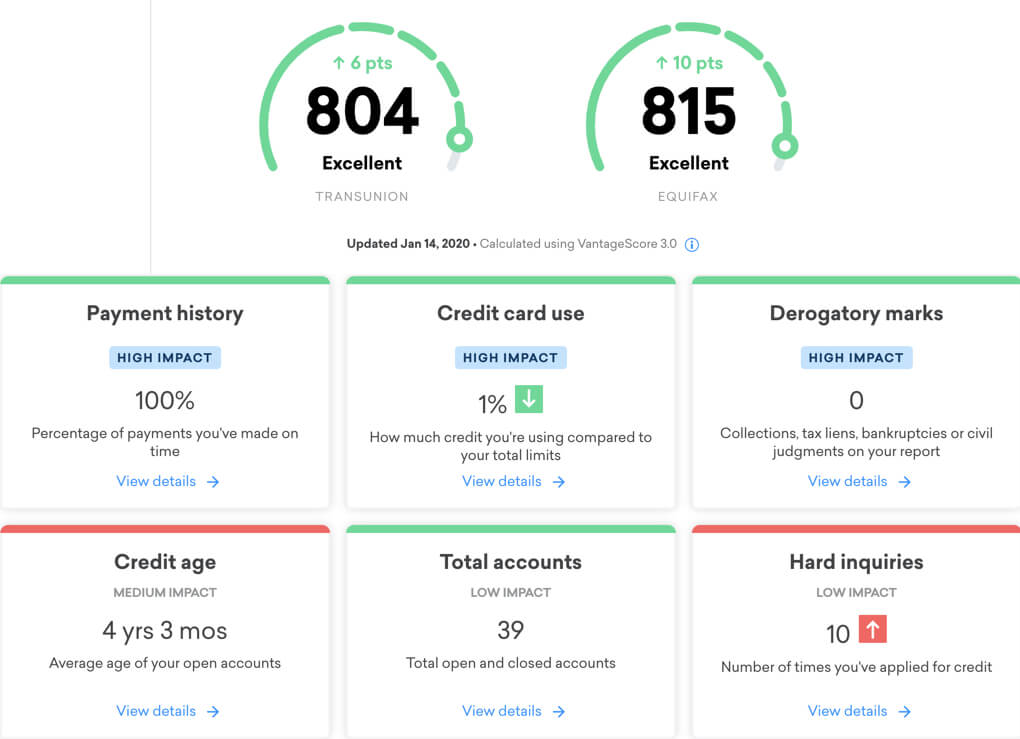

Credit score required for credit card. In general you need a good to excellent credit score to get a rewards credit card. Make sure your revolving utilization is below 30 when you apply or they may deny you. Issuers like to recruit student cardmembers because they feel it will result in brand loyalty that may last a long time after graduation.

A score of 740 or above is considered very good to exceptional. The Chase Slate credit card is a minimalist card with no rewards and relatively few perks. Student and secured credit cards generally have no credit score requirements.

Are you thinking about applying for a PayPal credit card. Bank Secured Visa Card are designed for consumers who are looking to. To have good credit your credit scores need to be in the 700s.

63 rows Generally you can consider 650 to be the minimum credit score cutoff for credit. 551 Credit Score Needed. In general however you have a fair chance of being accepted for a card if you have a credit score of 750 or above.

First the most commonly used credit score range is 300 850. In return it offers easy approval accepting credit scores in the 551 to 600 range for 8 of its cardholders according to a Credit Karma survey of cardholders. You may need a score of 570 or higher to be approved for the Capital One Platinum.

While our scale for good originally went as low as 680 youll have a much harder time getting approved for credit card offers the further below 700 your credit score is. In Canada most card providers view a credit score of 650 as satisfactory and those with credit scores above this level should have. It ultimately depends on the specific card provider and the requirements for each card premium cards will usually require a higher credit score.

This is the same for the Lowes Advantage Card and for Lowes Business Cards. TransUnion one of the three major credit reporting. How to Increase Your Chances of Getting Approved for a PayPal Credit Card.

On the other hand some secured credit cards offerings that require a refundable cash deposit that equals your credit limit dont require credit checks for acceptance. Premium cards that offer perks like complimentary airport lounge access may need a score of at least 740 for the best approval odds. For a basic rewards card youd need a score in the mid 600s.

A score below 580 is considered poor a score in the range of 580 669 is considered fair and a. Truth be told you can get many cards from the excellent group even if your score is below excellent although you may receive a slightly higher APR andor smaller credit line. The minimum credit score needed for a Lowes card is 620 FICO.

A top-shelf card with the richest rewards and greatest benefits will require not only excellent credit a credit score above 740 but also a solid proof of income and a low debt-to-income ratio. What credit score is needed for a credit card. To apply for a credit card there is no set minimum credit score.

Tom Giancolo chief credit risk officer with Mercury Financial which has offices in Austin Texas and Wilmington Delaware said that consumers typically need a FICO score in the low 600s to qualify for a basic no-frills credit card. You should always consider improving your. Most airline credit cards only need a minimum credit score of 650 or higher to get an instant approval decision.

Secured cards usually dont require a credit score since they are collateralized by your cash deposit. But a credit score is only one factor used to determine what kind of credit card youre likely to be approved for. Bank credit cards such as the US.

According to the 850-point FICO scoring model the one credit card issuers most commonly use a good score is 670 to 739. You should have high approval odds for a Southwest Airlines credit card with a score of at least 670. Most credit card offers require very good credit.

While not quite up to the standards set by credit cards for excellent credit scores the cards for good scores 670 739 have nothing to apologize for. Credit scores range from 300 to 850 with 300 considered a very poor score and 850 considered excellent. Getting approved for a credit card requires a little planning.

To accept an application for a card each bankcredit card company has its own conditions. The minimum recommended credit score for this credit card is 700. Bank does not publicly state what type of credit score is needed for each of its cards each card is designed with a different target consumer in mind.

Having a stable income and a history of on-time payments is also important. A good FICO credit score is 670 or higher or 700 or higher on VantageScore. Scores in the high 600s are borderline good.

/how-opening-a-new-credit-card-affects-your-credit-score-96050-final-5b60bade46e0fb0025b3bc98.png) How Opening A New Credit Card Affects Your Credit Score

How Opening A New Credit Card Affects Your Credit Score

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

Credit Cards And Credit Scores How Are The Two Related 13 April 2021

Credit Cards And Credit Scores How Are The Two Related 13 April 2021

Credit Score Requirements For Credit Card Approval

Credit Score Requirements For Credit Card Approval

![]() Best Credit Cards To Apply For With A 550 600 Credit Score Mybanktracker

Best Credit Cards To Apply For With A 550 600 Credit Score Mybanktracker

Credit Score Your Number Determines Your Cost To Borrow

Credit Score Your Number Determines Your Cost To Borrow

Best Credit Cards For Credit Score 600 649 Fair Credit

Best Credit Cards For Credit Score 600 649 Fair Credit

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Improve Your Credit Score In 6 Months Blog Details Essex Bank

Credit Cards And Credit Score Million Mile Secrets

Credit Cards And Credit Score Million Mile Secrets

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2021 Badcredit Org

12 Best Loans Credit Cards For 400 To 450 Credit Scores 2021 Badcredit Org

![]() 5 Top Credit Cards For Fair Credit Score Of 650 700 Mybanktracker

5 Top Credit Cards For Fair Credit Score Of 650 700 Mybanktracker

![]() How Secured Credit Cards Help To Build A Good Credit Score Mybanktracker

How Secured Credit Cards Help To Build A Good Credit Score Mybanktracker

Comments

Post a Comment